bfinance insight from:

Ori Gotfrid

Senior Director

Marco Stigler-Thomas, CFA

Director

Asset owner data from bfinance’s biennial Global Asset Owner Survey reveals key differences in investor sentiment across the 40 countries involved. Here, we examine five areas where investors in the DACH region departed from their international peers.

This study included insight from more than 40 investors in the DACH region (Germany, Austria, Switzerland) and nearly 400 asset owners in total. These included insurers, pension funds, endowments, foundations, family offices and others. Although diverse in terms of their objectives, liability profiles and regulatory frameworks, these investors are facing some common challenges amid today’s challenging macroeconomic climate. The full report can be found here.

Closer analysis of the data shows that asset owners in the DACH region are:

- … less likely than global peers to have increased the inflation-sensitivity of their portfolios

- … less likely to be increasing exposure to hedge funds, EM debt and leveraged loans, and far more likely than global peers to be ‘very satisfied’ with hedge fund performance.

- … showing more patience on their private market rebalancing.

- … less likely to be terminating managers for inadequate handling of ESG matters.

- …less likely to have observed fee reductions in alternative asset classes.

These points are discussed further below.

1. DACH INVESTORS ARE LESS LIKELY THAN GLOBAL PEERS TO HAVE INCREASED THE INFLATION SENSITIVITY OF THEIR PORTFOLIOS

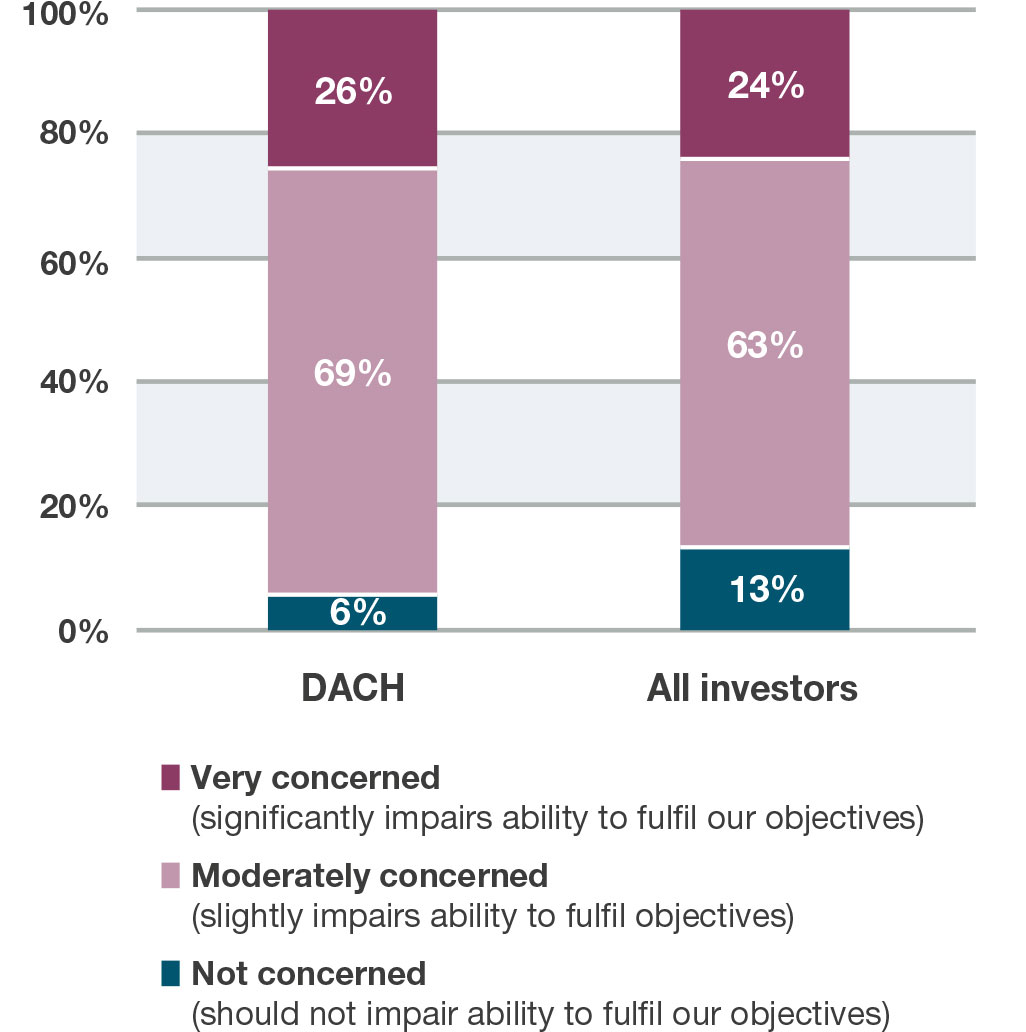

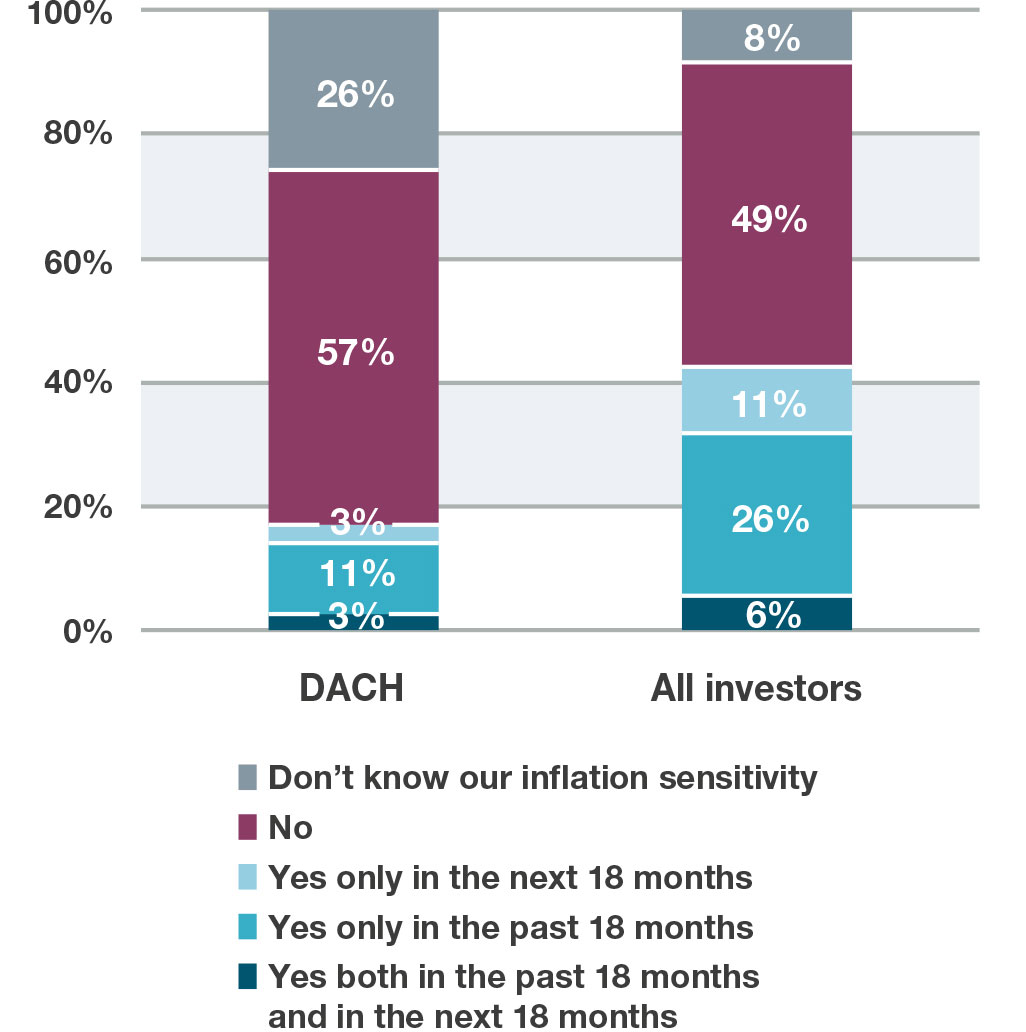

More than 90% of DACH-based asset owners in this study are concerned about inflation and rising rates, with a quarter saying that these forces could ‘significantly impair’ their ability to achieve investment objectives. Only 14%, however, have increased the inflation sensitivity of their portfolios in the past 18 months, versus 32% of global peers. Indeed, a full 26% of DACH respondents say that they do not know the answer, versus 8% of global investors, indicating a lack of clarity and modelling on the subject.

How concerned are you about the potenital damage that inflation and rising rates may have on yor ability to achieve investment objectives over the medium term?

Source: bfinance. For global data, see page 14 of the Global Asset Owner Survey.

Have you increased/are you increasing the inflation sensitivity of your portfolio?

Source: bfinance. For global data, see page 14 of the Global Asset Owner Survey.

Inflation sensitivity is a challenging topic. Investments offering explicit inflation protection, such as inflation-linked bonds, have been expensive for some time. Real estate, infrastructure and equities are widely expected to have some implicit inflation sensitivity, but that connection varies hugely depending on the details: the nature of each asset’s revenue models, the amount and type of debt involved (since inflation often triggers rising rates), and indeed the type of inflation (‘cost push’ or ‘demand pull’) can all play a role (related reading Will Your Infrastructure Investments Withstand Inflation?). Investors are also keenly aware of recessionary signals: many inflation-sensitive assets, after all, are recession-sensitive as well.

2. DACH INVESTORS ARE SIGNIFICANTLY LESS LIKELY THAN GLOBAL PEERS TO BE INCREASING EXPOSURE TO HEDGE FUNDS, EM DEBT, LEVERAGED LOANS

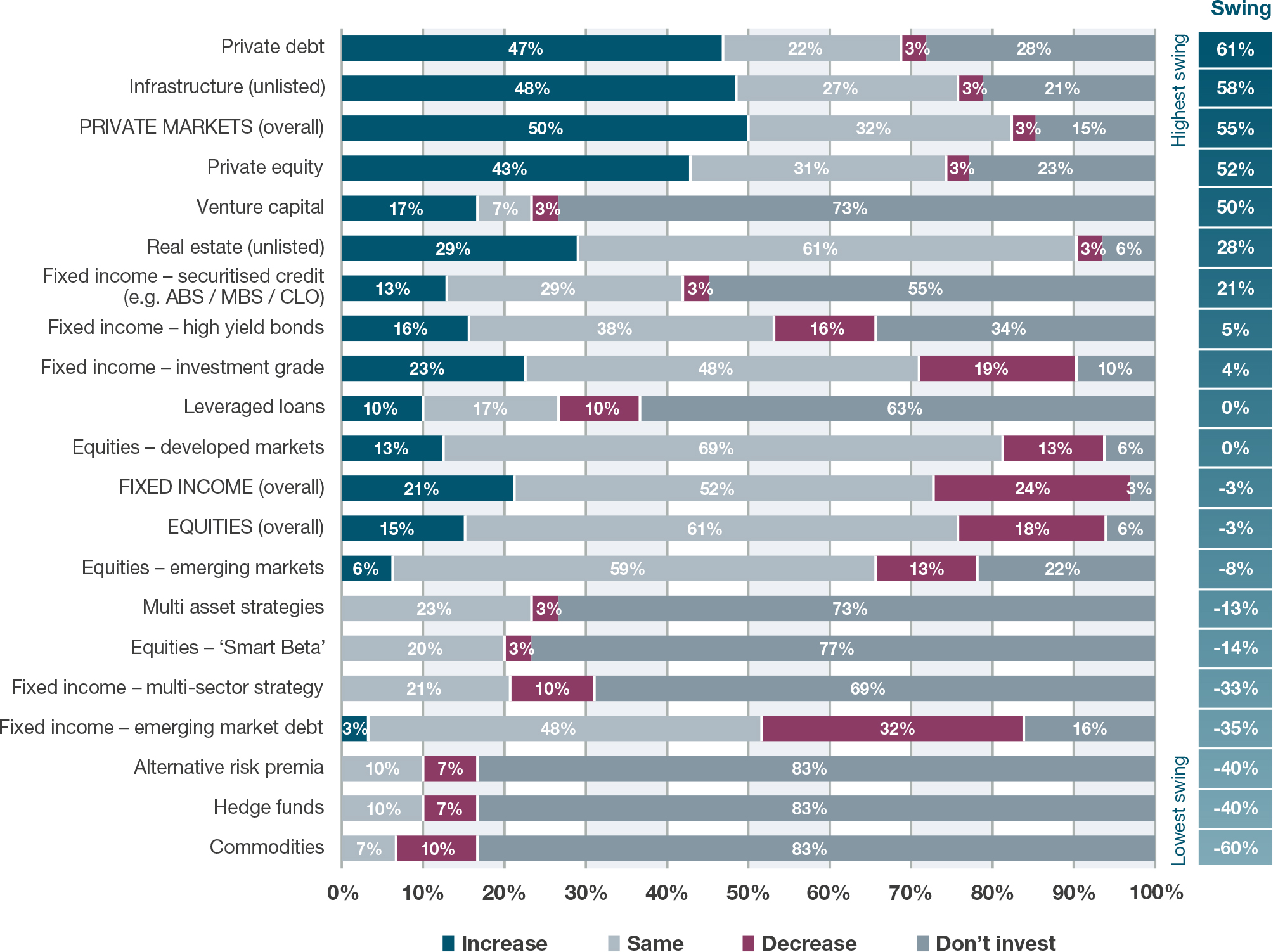

Overall, we see strong positive sentiment in favour of increasing exposure to private market strategies – in both DACH and global data. Yet other asset classes revealed some significant departures from the global trends. Three differences, in particular, stand out.

- Hedge funds: we see a -40% swing among the DACH respondents, as shown in the chart below, while global investors are neutral. In addition, only 17% of DACH investors surveyed use hedge funds, versus 49% of global investors.

- Emerging market debt: a -35% negative swing in DACH, compared with a -5% swing globally. However, DACH investors are more likely to use this asset class (84% of DACH investors have exposure to EM debt, versus 63% of global investors).

- Leveraged loans: there is no overall swing shown among DACH investors, whereas we see a 28% positive swing globally with respondents keen on the floating rate characteristics of this asset class.

How do you expect your exposure to the following sectors/asset classes to change over the next 18 months (as % of portfolio)? DACH investors

Source: bfinance, data for 41 investors. ‘Swing’ = (increasers-decreasers)/(those who invest). Global result can be found on page 12.

The hedge fund result is particularly interesting, given investors’ very high satisfaction with performance in this asset class: 100% of DACH HF investors indicated that they are ‘satisfied’ (majority ‘very satisfied’) with their HF performance in 2022 vs. 69% of global investors. We have seen especially strong performance with hedge fund strategies that are intended to provide ‘convex’ or ‘divergent’ return profiles (discussed in this recent article). DACH investors’ intended reductions in exposure could, in part, signify that investors are monetising those gains — rebalancing to strategic weights and redirecting money towards other areas. The key question: will we see new investors considering hedge funds for a long-term strategic allocation, in light of these positive results? Historically, hedge funds have proven to be relatively unpopular among institutional investors in DACH region compared with their global counterparts.

3. DACH INVESTORS ARE SHOWING MORE PATIENCE IN REBALANCING PRIVATE MARKET ALLOCATIONS

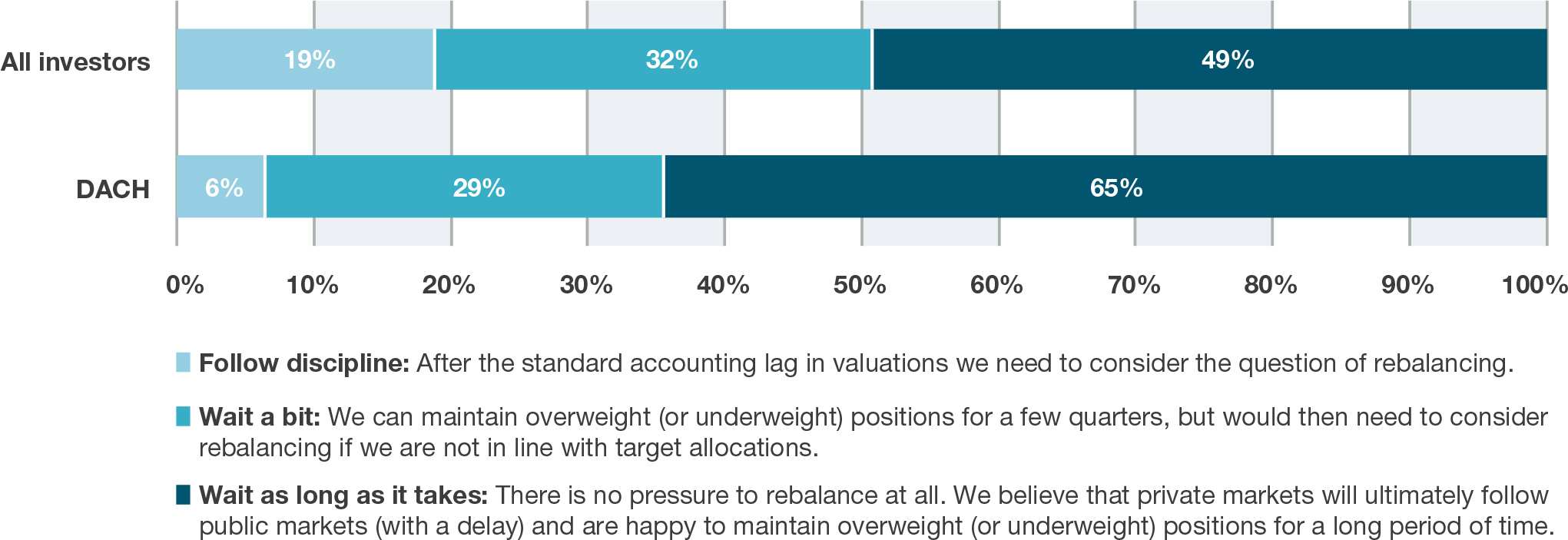

Asset owners in this region have—like others—suffered from the ‘denominator effect’ in 2022: declines in public market portfolios can leave investors overexposed to private markets, where valuation changes are slower and less aggressive. Yet the data suggests that investor respondents in this region are able to be more patient with rebalancing, on average, than their global peers.

If you invest in private markets, how do you approach the topic of rebalancing private market exposures when there are large dislocations in public markets? DACH investors vs. All

Source: bfinance. Global result, segmented by investor type, can be found on page 19.

The ability to be long-term is a meaningful advantage in institutional investment, if it is used effectively. Less pressure to rebalance means that positions can be held until a (potentially more attractive) exit. Patience with over-allocation can also allow investors to take advantage of timely opportunities in both secondary and primary markets.

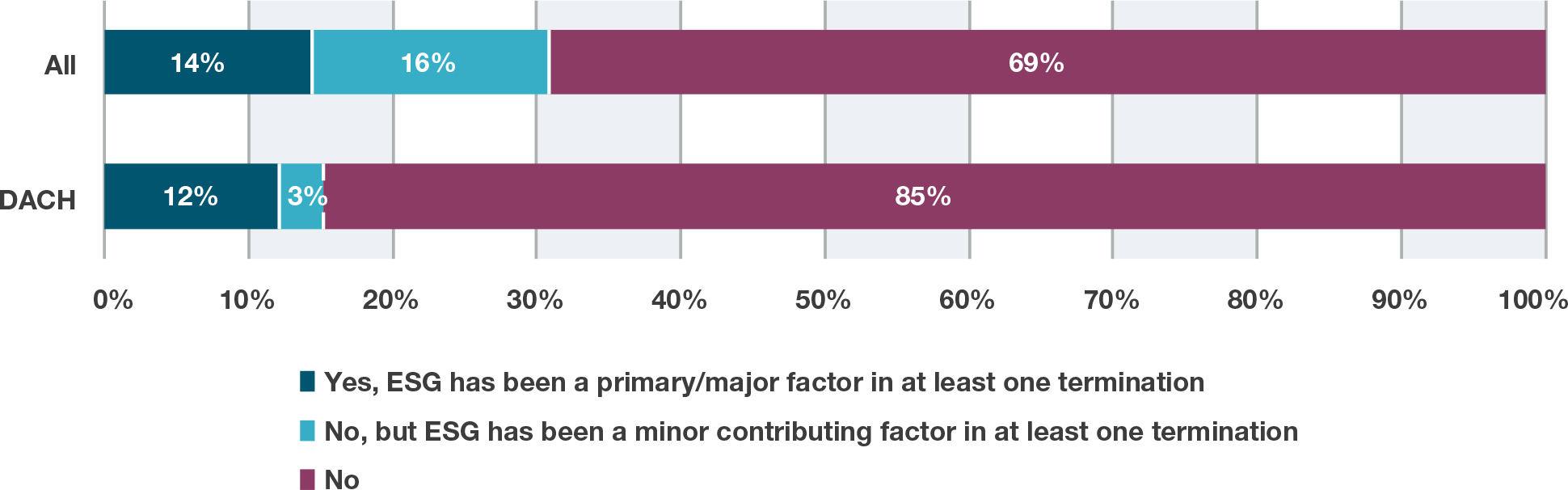

4. DACH INVESTORS ARE LESS LIKELY TO BE TERMINATING MANAGERS FOR INADEQUATE HANDLING OF ESG MATTERS

Investors in this region show a strong focus on ESG matters. Indeed, they are more likely than international peers to say that they integrate ESG considerations into the investment process, and are just as likely to require carbon reporting. However, only 15% have terminated an asset manger where ESG issues contributed to that decision, whereas 31% of global investors have done this.

Has your institution ever terminated a manager where ESG considerations have a major factor in that decision? DACH investors vs. All

Source: bfinance. Global result, segmented by investor type, can be found on page 24.

It is crucial for investors to hold managers to account on their ESG standards. Although clients can encourage their asset managers to improve through existing relationships, the threat of losing capital represents the strongest incentive for change. We see large variations in the quality of ESG approaches among the asset management community.

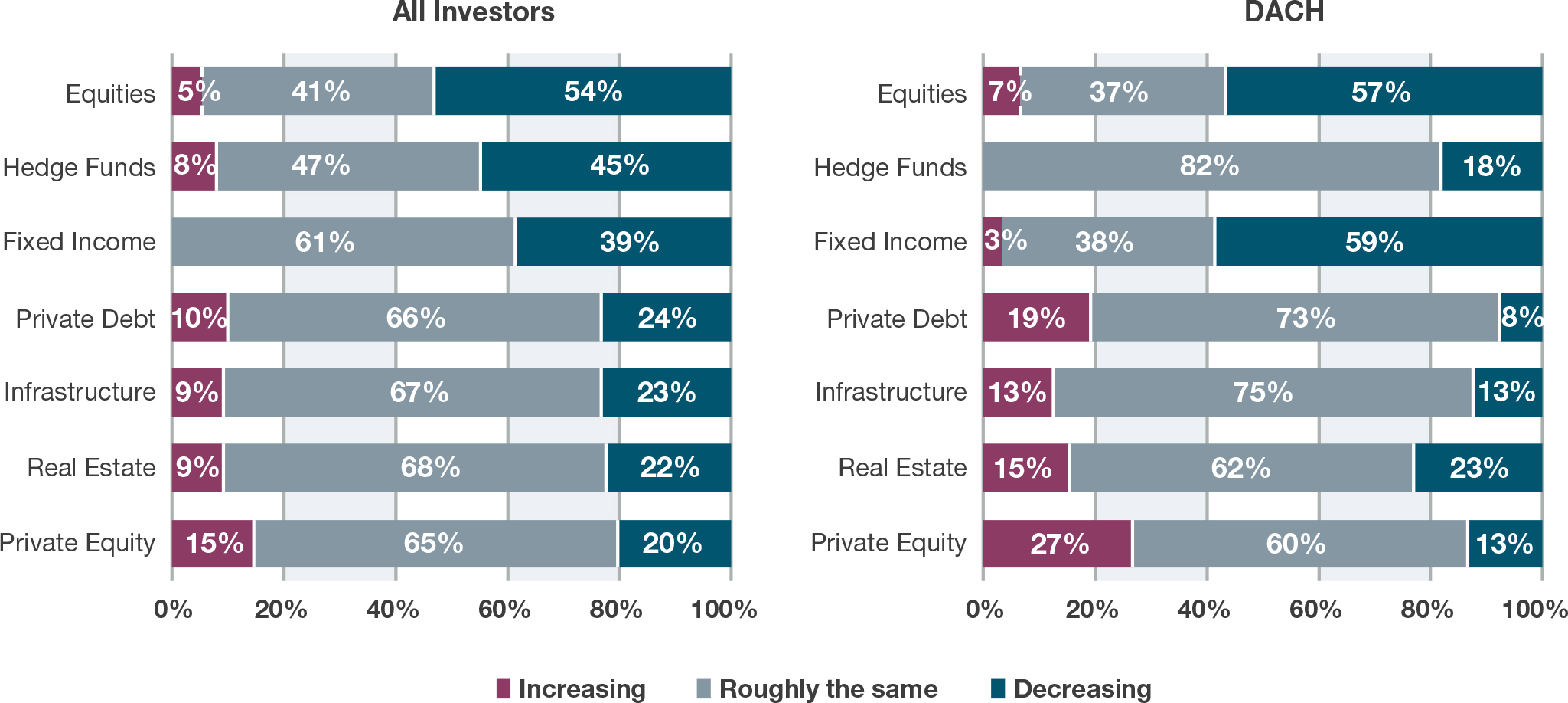

5. DACH INVESTORS ARE LESS LIKELY TO HAVE OBSERVED FEE REDUCTIONS IN ALTERNATIVE ASSET CLASSES

Staying abreast of fee developments in the industry can be extremely helpful in improving portfolio efficiency. A strong understanding of trends can support renegotiations of fees in existing asset classes and may also play a role in asset classes where cost may be a prohibiting factor. As such, interesting to note that DACH investors are markedly less likely to have observed fee reductions in various illiquid asset classes and hedge funds.

Do you believe that fees for ‘like-for-like’ strategies in these sectors have been increasing or decreasing during the last 3 years?

Source: bfinance. Global result, segmented by investor type, can be found on page 28.

Only 18% of DACH investors believe that hedge fund fees (‘like-for-like’) have declined in the past three years, versus nearly half of global investors who say they’ve seen reductions. More than a quarter of investors in the DACH region believe that private equity fees (‘like-for-like’) have increased in the past three years, compared with 15% of global peers: indeed, global investors were more likely to say that fees in that asset class had reduced. Only 8% of DACH investors say that fees in private debt have declined, whereas 24% of global peers say there have been savings in this asset class.

Notwithstanding the differences we have discussed, investors in the DACH region showed a great deal of consistency with their international counterparts in this study. Asset owners around the globe must now make difficult choices about their exposures in a challenging climate – and gain the support of their boards and stakeholders in making those decisions. Over the long term, the experiences of 2022 are likely to shape practitioners’ approaches to asset allocation, risk control and strategy selection for years to come.

English (Global)

English (Global)  Français (France)

Français (France)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)