IN THIS PAPER

Hedge funds for all-weather tail protection

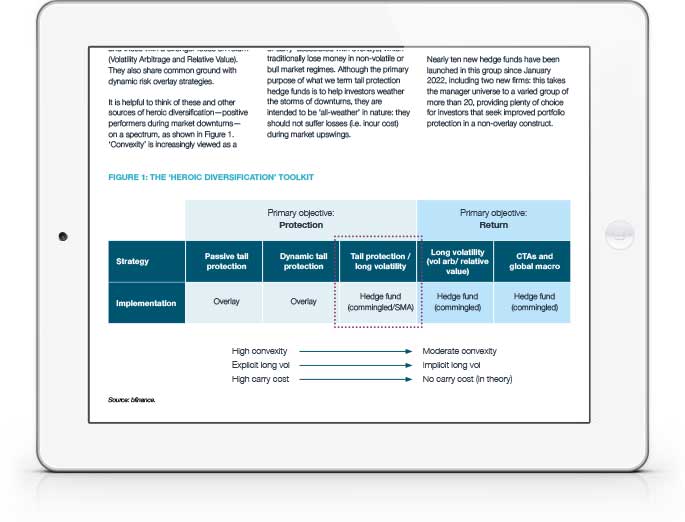

Understanding the spectrum of ‘heroic diversification’ strategies: Hedge funds that offer all-weather tail protection sit on a spectrum of strategies that provide convexity with positive performance during market downturns. These range from the most explicit forms of tail protection—passive overlays—to the most implicit (hedge fund strategies such as global macro and CTA, for example, have historically proven likely to deliver positive performance in market downturns). All-weather tail protection strategies are often described as Long Volatility hedge funds, but should not be confused with more return-oriented Volatility Arbitrage and Relative Value offerings.

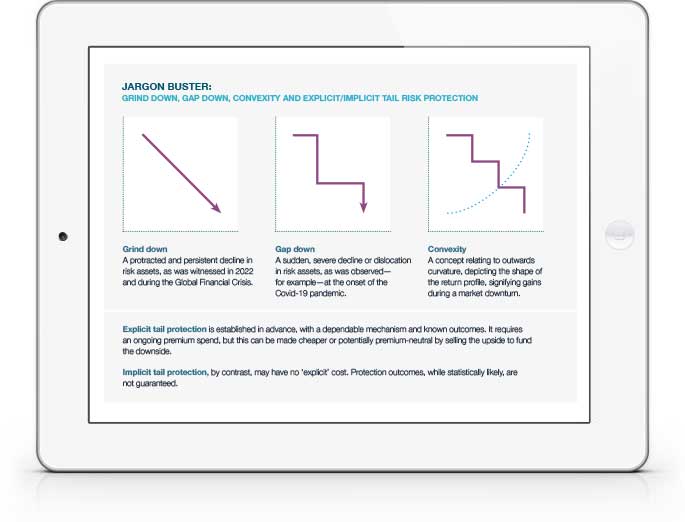

Investment processes and performance: Hedge funds providing all-weather tail protection typically use a blend of sub-strategies to achieve the desired effect. These include (a) highly convex options-based tail protection to deliver large infrequent payouts in periods of sharp dislocation and (b) moderately convex long volatility techniques that tend to do better in periods of prolonged derisking. This combination is designed to provide protection in both ‘gap-down’ and ‘grind-down’ scenarios. They often feature a third strategy sleeve (c) focused on market-independent returns, designed to help offset the explicit carry cost of the options-based strategies.

Implementation and asset manager selection: Nearly ten new commingled funds have been launched in this group since January 2022, including two new firms. This takes the manager universe to a varied group of more than twenty. These managers typically also offer SMAs for sufficiently large mandates. Usefully, these managers tend to offer suites of sub-products—such as a deep tail protection strategy, a CTA, or accessible components of a long volatility book—so that investors can tailor-make allocations even where they are restricted to commingled fund structures.

WHY DOWNLOAD?

Sources of tail protection are gaining prominence

Sources of positive return during downturns (‘convexity’) are increasingly viewed as a necessity rather than a luxury for institutional investors. Periods such as H1 2020 and 2022 challenged prevailing portfolio diversification paradigms. With heightened equity market volatility in 2024, investors are paying close attention to the variety of strategies that offer convexity in different ways.

The concept of using overlays for tail risk protection—whether more active or passive in style—is a well-established technique in the institutional investor’s arsenal. Less familiar to many, however, are the hedge fund strategies whose primary goal is to offer sizeable positive returns during downturns as well as small positive returns during benign periods (an ‘all-weather’ profile).

Indeed, there are several reasons why investors may indeed prefer to use hedge funds rather than employing an active or passive overlay. In some cases, the choice may be due to the structure of the institution: for Wealth Managers handling portfolios for multiple underlying investors and certain Defined Contribution pension structures, a risk overlay on a multi-client portfolio may be unfeasible. More broadly, many investors are unable or unwilling to tolerate the ‘cost of carry’ associated with overlays, which traditionally lose money in non-volatile or bull market regimes.

While the gains made by ‘all-weather tail protection’ hedge fund strategies are not likely to insulate asset owners from portfolio losses, due to the small investment sizes versus investors’ equity allocations, they can offer a positive stream of returns at precisely the time when this effect may be most valuable – when market/portfolio liquidity may be reduced, when there are likely to be attractive investment opportunities to exploit in other asset classes, or indeed both.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)