IN THIS PAPER

Market confidence through Q2 remained relatively strong and risk appetite reflected this, with multi-asset managers’ exposure to equities rising to 39%, up from approximately 33% twelve months prior and considerably higher than the long-run average weighting of 35%. This may come as a surprise to some, given that equities did not offer particularly attractive buying opportunities in the quarter and, more recently, over-allocations to equities were punished at the start of Q3.

Asset manager performance in the Investment Grade space was particularly attractive, with more than 96% of managers in the US outperforming the benchmark, net of fees. Managers in this category still performed well in Europe, where 64% of managers outperformed, net of fees. A majority of this outperformance can be attributed to managers being overweight in lower quality BBB issuers, which outperformed higher quality names.

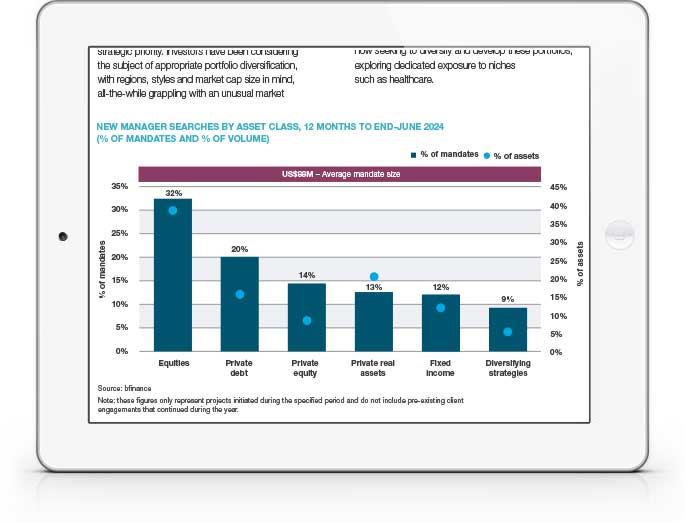

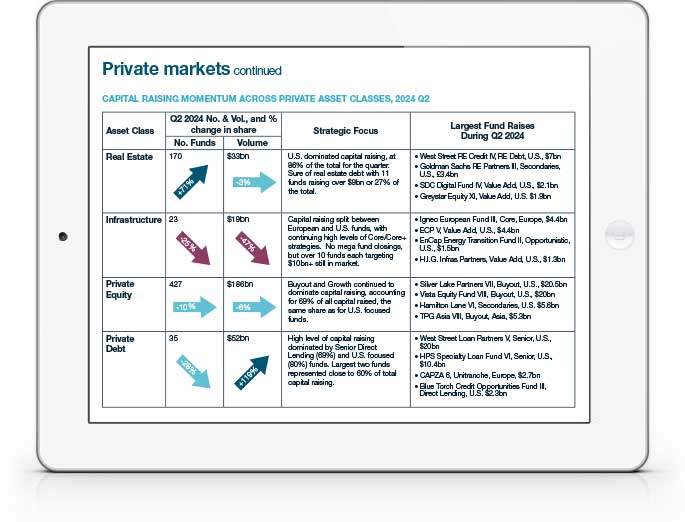

Demand for Private Market managers remained somewhat subdued in the twelve months to the end of the second quarter, accounting for 47% of all new mandates, up marginally from the 43% recorded in the previous twelve-month period. However, given that fundraising levels are still at the lowest point in over a decade, one could argue that this slight increase in appetite is a ‘win’ for the asset class, particularly for Real Estate investors who could benefit from a recovering market after the recent dislocation.

‘Higher for longer’ continues to be a dominant macroeconomic theme of 2024. Despite doveish signals from the Fed towards the end of 2023, rates have remained stable, but investors are anticipating that the Fed will start to ease towards 4%, down from the current Federal Funds rate of 5.5%, with a (small) cut widely expected to take place next month. Some rate markets, however, have already seen cuts, with Canada moving from 5.0% to 4.75% in June, followed by the ECB’s shift from 4.0% to 3.75%.

WHY DOWNLOAD?

Each quarter, bfinance publishes information on investor activity, key market trends and manager performance. A quarterly snapshot of the key developments within equity, fixed income and alternative investments, including analysis of which asset manager groups performed well and which didn't.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)