IN THIS PAPER

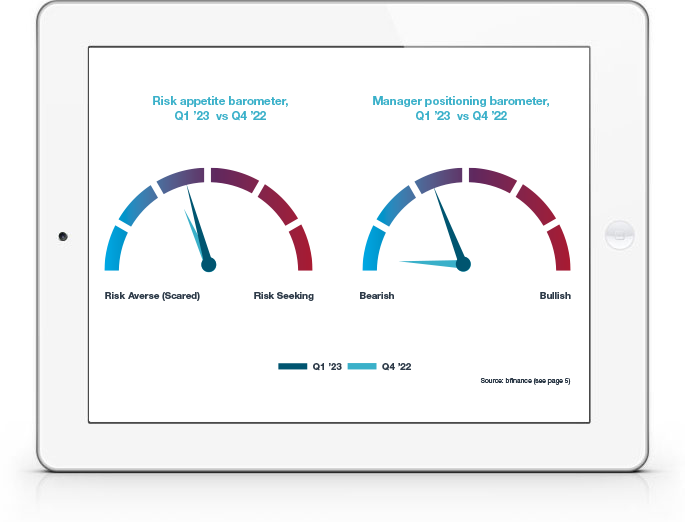

While equity markets trended upwards in the first quarter of 2023 with the S&P 500 up 17% from its low in October 2022, institutional investor demand for the asset class also warmed back up: the number of new equity manager searches initiated by bfinance clients in Q1 was equal to the previous three quarters combined.

bfinance’s Risk Aversion index has moved out of bearish territory, driven by improvement in a range of market indicators.

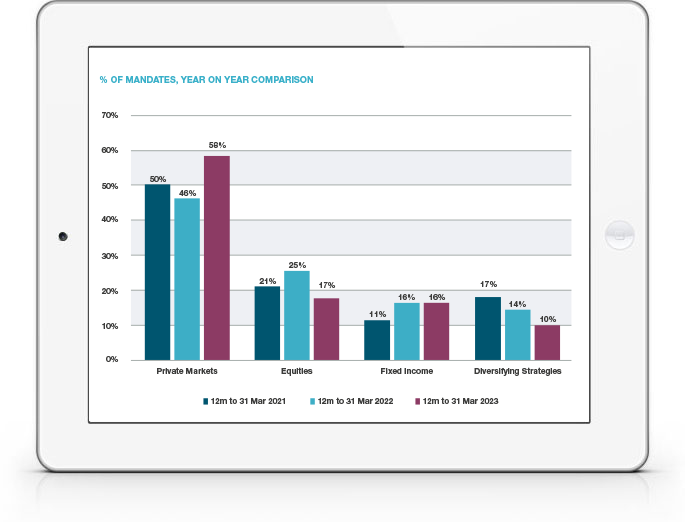

Private market asset classes continue to dominate new manager search activity, accounting for almost 60% of all new mandates from bfinance clients in the 12 months to 31 March 2023. Notwithstanding the ‘denominator effect’, sophisticated institutional investors have largely succeeded in retaining a longterm perspective and continued to allocate to current promising vintages.

Active manager performance relative to benchmarks was particularly strong in investment grade credit; the same was true of growth-oriented equity managers, with factors back in the driving seat in developed markets.

Global macro and CTA hedge fund managers struggled, following the outstanding run of trend following diversifying strategies in 2022.

Appetite for real estate manager searches declined as investors favour new private debt commitments.

WHY DOWNLOAD?

Each quarter, bfinance publishes information on investor activity, key market trends and manager performance. A quarterly snapshot of the key developments within equity, fixed income and alternative investments, including analysis of which asset manager groups performed well and which didn't.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)