bfinance insight from:

Kathryn Saklatvala

Director, Head of Investment Content

Nicholas Shade

Associate, Private Markets

With crisis conditions historically proving beneficial for new private equity secondaries funds, 2020 has seen a surge in fundraising and fund launches. Yet there are problematic questions for investors to address.

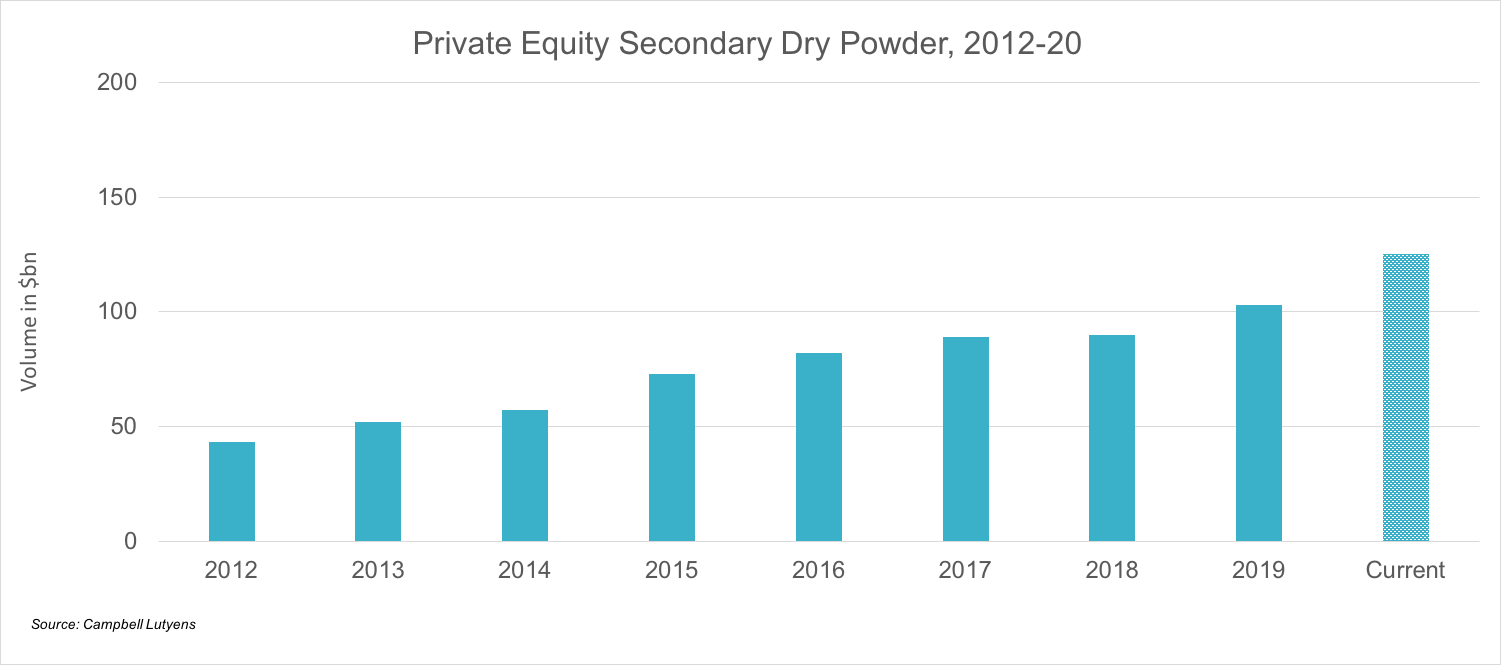

The COVID-19 era has, so far, been a challenging period for secondaries investors. More than half a year after many countries ‘locked down’ there are still few easy pickings to be had. Transaction volumes declined dramatically in the first half, down an estimated 30% versus the prior year (Preqin), and while numbers have picked up somewhat in the most recent quarter, especially for GP-led transactions, they are still below 2019 levels. The volume of dry powder targeting secondaries has mounted, with estimates now exceeding US$125 billion (Campbell Lutyens) compared with the previous record of approximately US$103 billion in 2019.

There is no doubt that recent months have favoured sellers

As a result, high-quality positions are broadly still trading at very small discounts – or no discounts at all – to NAV. While there appears to be widespread consensus that conditions should become more favourable for buyers as the effects of the virus continue to play out, there is no doubt that recent months have favoured sellers.

These dynamics do not, however, appear to have dissuaded asset owners. Based on fundraising data and anecdotal client evidence, investors appear willing to ride out a temporary period of market buoyancy in anticipation of market dislocation and liquidity pressures in the months and years ahead, which should – according to received wisdom – produce a wave of attractive opportunities. Historic performance figures do, on the surface, support demand: Institutional Investor recently reported on data suggesting that secondaries funds launched during the 2008 Global Financial Crisis and the 2010 European Debt crisis have outperformed regular private equity funds by up to 216bps per year.

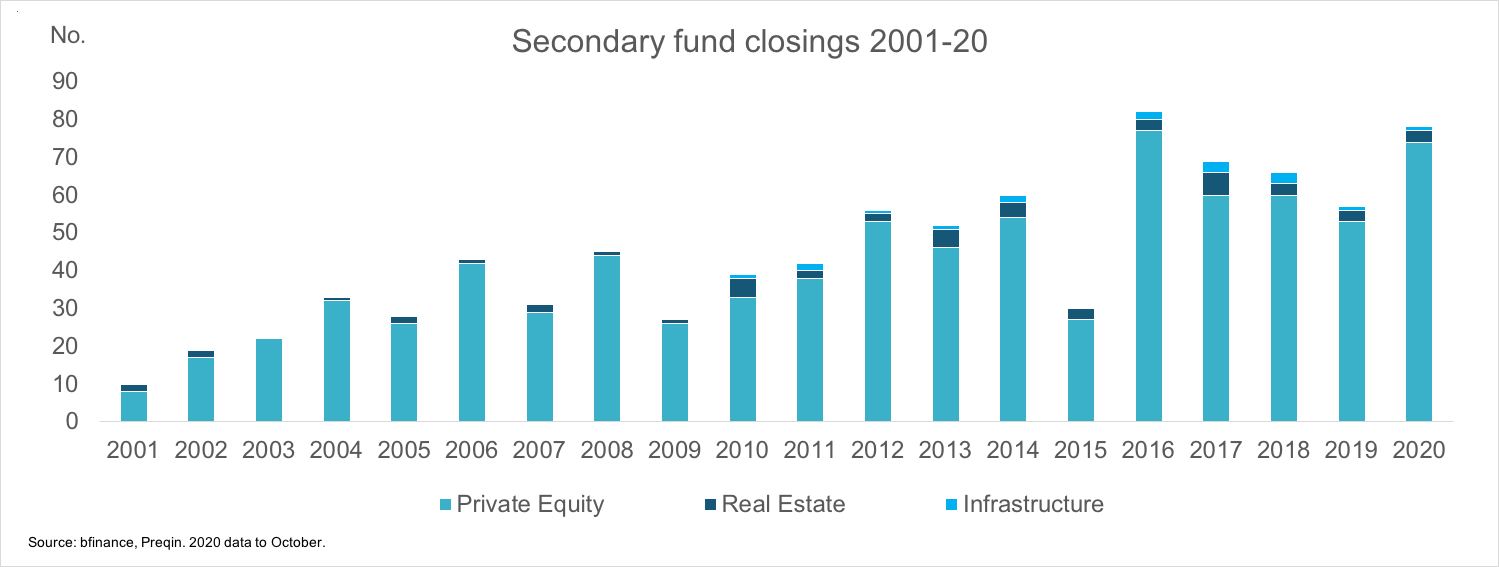

Although the history is compelling, the secondaries market has changed dramatically during the last decade, both in size and in terms of the nature of transactions. For example, the annual transaction volume of PE secondaries was about US$40 billion five years ago; today the figure is closer to $100 billion. GP-led transactions, which were virtually unheard of a decade ago, now represent 30% of that volume (41% in H1 2020, according to data compiled by Bloomberg), and are becoming increasingly complex.

At the same time, investors’ needs and priorities have also changed. There is an increasingly strong focus on Environmental, Social and Governance (ESG) considerations, which can prove challenging in low-control scenarios such as secondary fund positions. More asset owners are concentrating on building up direct and co-investment exposure. Investors are exposed to a wider variety of illiquid strategy types, with infrastructure and private debt playing a more prominent role in portfolios.

With these shifts in mind, we asked bfinance’s private markets specialists four key questions about investing in secondaries now.

1. What types of managers/strategies are available for private equity secondaries?

The rapid growth of the sector in recent years has mainly been concentrated in the hands of the biggest asset managers. Of the 11 funds that closed in the first half of 2020, for example, the two largest raised USD23 billion out of a total of USD44 billion. Smaller funds tend to focus on particular niches of the market where there is less competition from the big houses.

The rapid growth of the sector in recent years has mainly been concentrated in the hands of the biggest asset managers

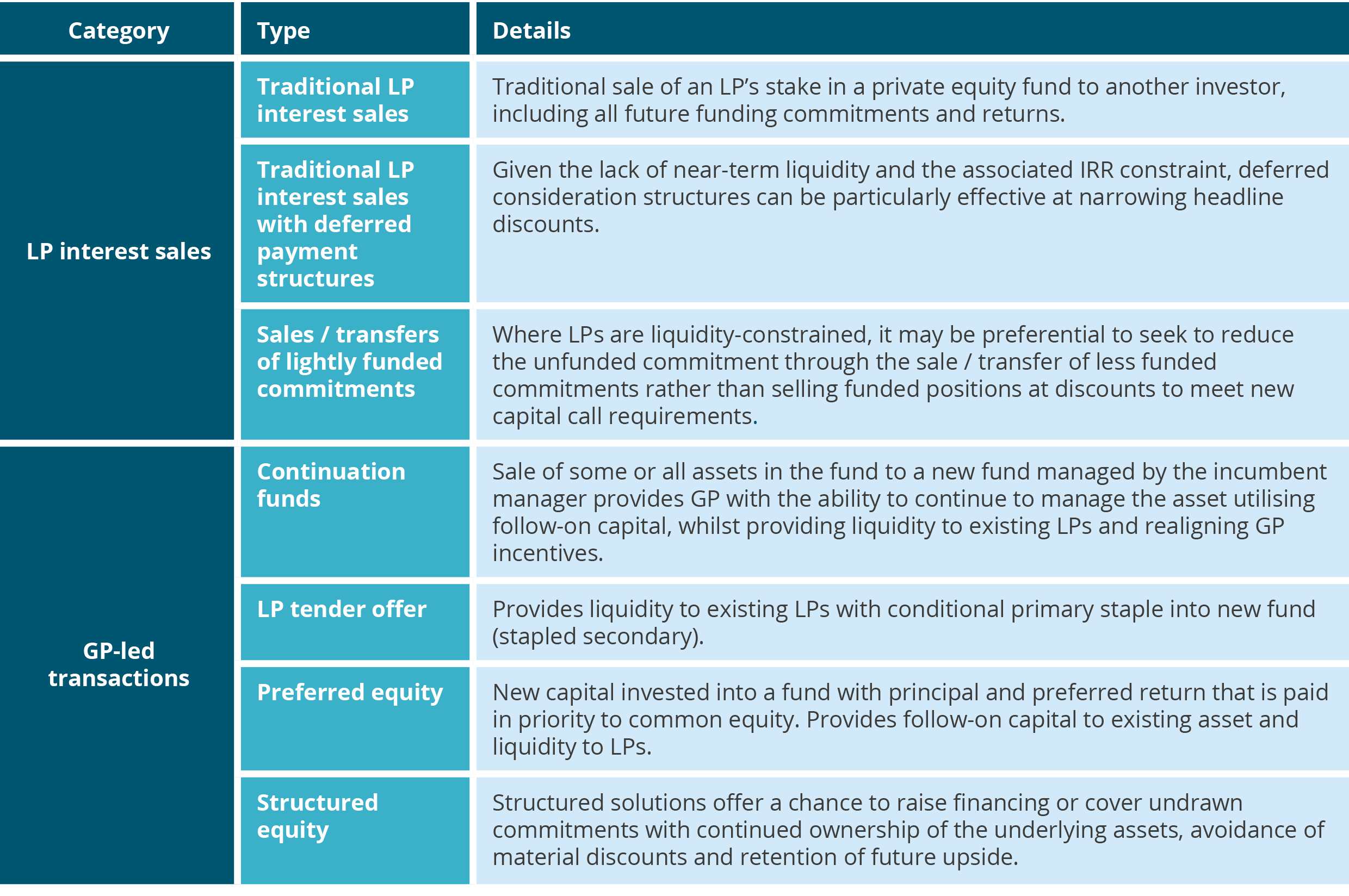

The rising proportion of GP-led transactions versus traditional LP interest sales within overall secondary PE transaction volume is a subject that attracts mixed opinions. GPs are, we’re often told, looking for partnerships that will help them hold onto high-quality, high-performing assets for even longer, in order that they – and their clients – can continue to benefit. The reality, of course, is far more nuanced.

There are certainly some valid reasons for concern. GP-led transactions do tend to be significantly more complex than LP sales – although this complexity can also be associated with a return premium. They involve some significant potential conflicts of interest, as flagged by both the Institutional Limited Partners Association (ILPA) and the Securities and Exchange Commission (SEC); for example, where the GP effectively acts as both buyer and seller, they may want to get the highest possible price since they are realising carry on the exit, or may wish to artificially depress the price to boost future performance. Thirdly, the rise in GP-led transactions may also be symptomatic of a shortage of attractive conventional exits for PE investors: continuation fund type structures, ultimately, provide an alternative route for the GP to gain liquidity.

But investors absolutely should not conclude that GP-led transactions are broadly more risky or less attractive than LP interest sales. All managers nowadays tend to do both. Indeed, we see some managers expressing a strong preference for GP-led space, concentrating the majority of investment activity in that area. That being said, GP-led transactions require different capabilities and skillsets; investors should select managers with care. The most important features include strong primary relationships to provide managers with ‘first look’ at GP-centred transactions, flexibility in structuring transactions and the ability to develop structures that provide strong alignment of interest with GPs.

3. How can investors align secondaries investments with Environmental, Social and Governance (ESG) priorities?

ESG issues are of increasing importance to our clients across all liquid and illiquid asset classes. Yet secondaries investing can prove challenging from this perspective. There have been some improvements: most managers do follow very basic exclusion-type protocols (e.g. anti-slavery, no tobacco, no cluster munitions) and an increasing proportion have made demonstrative commitments, such as developing ESG policies or becoming signatories to the Principles for Responsible Investment. A number of progressive managers now do thorough bottom-up ESG analysis on underlying portfolio companies. Yet the basic problem remains: ultimately the secondaries investor simply has less influence on what’s in the portfolio and less influence on the underlying portfolio companies.

Structures can be created which remove the exposure to particular companies from the overall portfolio

We have seen the development of some interesting innovative solutions in this area, some of which have been helpful for our clients. Structures can be created which remove the exposure to particular companies from the overall portfolio, so that they can fit with the investors’ ESG guidelines. They include:

- Synthetic swaps. This is a structure in which the manager can assume all the economic impact (positive and negative) if a company enters the portfolio which breaches ESG parameters – from the day at which that breach is discovered.

- Bond-like structures. From the day of discovery of a breach, the investment in that particular asset can be treated as if the investor had simply lent money to the manager, repayable at a pre-agreed interest rate.

- Punitive measures. These can include fines payable by the manager, redemptions of management fees, reduction in carry or other similar approaches.

4. Should we be thinking about secondaries in other illiquid asset classes such as real estate, infrastructure and private credit?

Secondaries, co-investment and fund-of-funds are all far more developed in the private equity space than in other illiquid asset classes, due largely to the greater size and maturity of the sector. However, the post-GFC period has seen a notable rise in secondary (and co-investment) transaction activity across a number of private asset classes. This trend has, in large part, been underpinned by the expansion of the primary markets (and numbers of primary funds) in these same asset classes.

There are different motivations for investors seeking secondaries in different illiquid asset classes. For example, in an asset class where the investor has only recently built an allocation, secondaries investments can help to improve the vintage diversification of the portfolio; this is less likely to be the case in an area such as real estate, where the average institutional investor tends to have a longer track record. In asset classes or strategies that exhibit a substantial J-curve (e.g. closed-end private equity, infrastructure and real estate funds), secondaries investment can help to mitigate that initial drawdown effect; this mitigation is less pertinent in direct lending strategies where assets are deployed more rapidly, fees are charged on invested assets rather than commitments and funds have a shorter lifespan.

There is some blurring of the lines across asset classes between “secondaries” and “distressed investment”, especially given the broader range of structures that are now covered by the former term. In real estate, for example, we see “rescue capital” secondary transactions involving funds, JVs or separate accounts that are in various stages of distress and require recapitalisation with an asset repositioning or value-add focus. In private debt, distressed credit strategies often involve recapitalising interests but don’t tend to be called “secondaries”.

As in private equity, we see some other sectors replicating the aforementioned trend towards more complex GP-led transactions. In infrastructure, for instance, we have seen a number of GP restructurings (aka continuation funds) whereby the GP continues to manage the assets but for a new investor base. Another similarity between private equity and infrastructure is the current difficulty in securing transactions at meaningful discounts to NAV, given the competition among buyers; the use of leverage is highly relevant in enabling managers to improve returns.

What’s on your mind?

We continue to watch the secondaries markets with interest, across private equity and other asset classes, cognisant – at this particular time – of the historic potential to generate outsized returns following periods of dislocation and difficulty. The market, however, has become significantly more complex and convoluted. Investors should scrutinise prospective asset managers, their relationships, capabilities and potential conflicts of interest with care. Investor readers are very welcome to send further questions on this subject for the bfinance private markets team. Simply email yours to

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)