bfinance insight from:

Robert Doyle

Managing Director, Equity

Weichen Ding

Director, Equity

Asset owners are now grappling with fundamental tensions within equity portfolio design. The runaway performance of tech titans has led to fears of market over-concentration. At the same time, investors appear increasingly reluctant to take significant active risk versus the benchmark, due to Fear of Missing Out on upside or vulnerability to aggressive style rotations. The result: growing demand for benchmark-aware strategies, whether active (‘core’) or quasi-passive (‘Enhanced Indexation’).

As we look at equity manager search data among bfinance’s institutional investor clients in 2024 and current expectations for 2025, two interesting and interconnected trends emerge.

On the active management side, ‘core’ benchmark-aware strategies are increasingly being favoured by allocators versus strategies that align with a particular factor or style – such as value, quality or growth. In the twelve months to end-September 2024, more than 50% of bfinance client searches for active equity managers were directed towards ‘core’ strategies; a more typical proportion during the 2017-2022 period would have been around 25%. More broadly, we see a somewhat reduced tolerance for taking active risk – an intriguing contrast with the previous decade, where so-called ‘benchmark-hugging’ strategies often received heated criticism from industry commentators.

Meanwhile, on the quasi-passive side, we note heightened interest in Enhanced Indexation strategies with relatively tight constraints. An educational primer on Enhanced Indexation can be found below. This contrasts with somewhat muted demand for higher-tracking-error Smart Beta approaches that would typically favour a certain factor or factors (similarities and differences between Enhanced Indexation and Smart Beta are explored further below). Enhanced Indexation provides an interesting alternative for investors that are keen not to deviate too much from market indices (or indeed pay active management fees) but wish to steer clear of purely passive investment approaches for various reasons.

Out of style?

The warmer sentiment towards core or benchmark-aware approaches—whether in an Enhanced Indexation or an active management methodology—versus ‘style’ allocations should be viewed in the context of recent market returns.

The turbulent twenties have been characterised by aggressive style rotations, with various academically established factors doing well one year and poorly the next, leaving investors counting the cost of substantial factor-attributable underperformance. Indeed, two of the three original Fama-French factors are now highly vulnerable to academic revision. In this climate, many active equity managers have struggled to beat market benchmarks consistently. Even those who should theoretically be favoured by the factor du jour have sometimes struggled to keep pace with a market whose returns were increasingly dominated by the ‘Magnificent Seven.’ Indeed, it’s worth observing that a significant minority of investors (36%) now report being broadly dissatisfied with the results of that their active equity managers have delivered relative to their benchmarks, according to the latest bfinance Global Asset Owner Survey, compared with just 17% who (for example) express dissatisfaction with the performance of active investment grade fixed income managers relative to benchmarks.

Yet there are further considerations that are contributing towards interest in Enhanced Indexation (‘EI’). For example, investors are seeking to incorporate specific constraints and parameters in passive-like portfolios for reasons that are not purely related to investment risk/return, such as carbon intensity or climate risk (see Passive ESG Investing). Moreover, we see greater willingness among investors to develop their own customised quasi-passive approaches rather than relying on an existing product suite; working with an asset manager on an Enhanced Indexation solution can be a relatively efficient and flexible approach, in comparison with working directly with an index provider to build a new customised index. In addition, we see notable innovations taking place in the EI segment: the rise of Artificial Intelligence as a tool within investment process, for example, is highly relevant within systematic rules-based strategies and many of the newer EI strategies do feature a notable AI or machine learning dimension. This subject is discussed in the primer below (see part 2: Three main types of Enhanced Indexation).

We hope that the following primer helps to support investors who are seeking to improve their familiarity with Enhanced Indexation and understand the different implementation approaches that can be pursued in this space.

Enhanced Indexation: A Primer

- Recognise the difference between Enhanced Indexation and Smart Beta.

- Understand the three main types of Enhanced Indexation strategy: traditional, alternative, and analyst-guided.

- Evaluate the risk/return profiles and customisation options of Enhanced Indexation strategies.

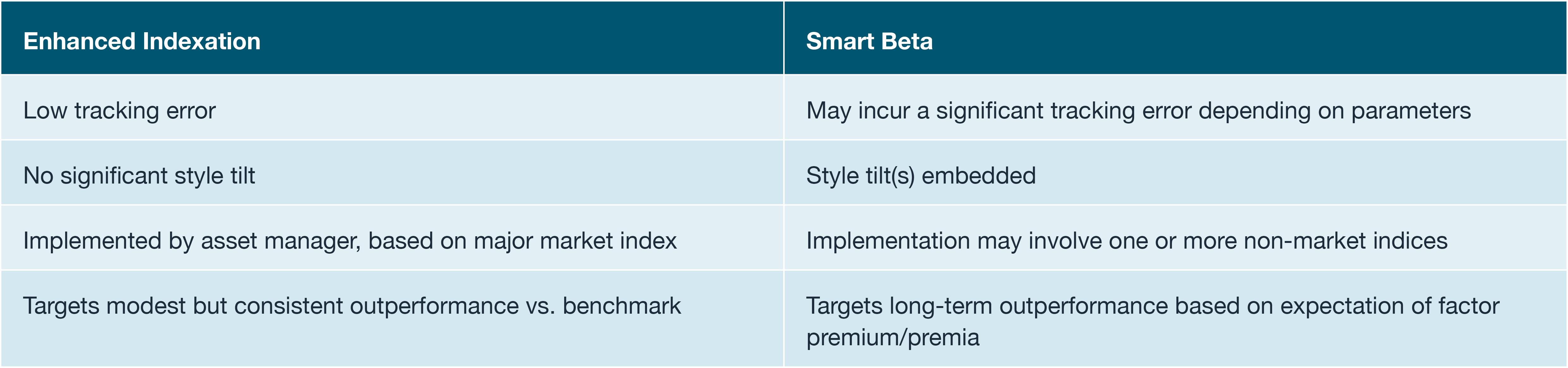

1: Differences between Enhanced Indexation and Smart Beta

Enhanced Indexation and Smart Beta are conceptual cousins. Both present innovative quasi-passive investment approaches, in that they are driven by systematic rules-based implementation rather than discretionary judgement. Both aim to deliver ‘better’ outcomes than simple index replication, and both should be offered at a significantly lower price-point than active strategies.

Yet they cater to investors with different priorities and approaches; they also diverge in their design, objectives, and implementation.

Enhanced Indexation emphasises low active risk (tracking error of 0.5–2.0%) to reduce the likelihood of significantly underperforming the benchmark. Although style factors are often integrated within construction, EI strategies leverage various stock selection methods (see part 2), employed directly by an asset manager rather than drawn from external factor-tilted indices. With these constraints in place, EI strategies seek modest but consistent outperformance, typically targeting excess returns of 0.5–1.5% (net of fees).

Smart Beta strategies, on the other hand, are rules-based, passive investment approaches that tilt toward specific factors or characteristics (e.g., value, growth, dividend yield) instead of following traditional market-cap weighting. These approaches often result in stronger style biases and higher active risk than we would find in Enhanced Indexation. Use of Smart Beta is based on an investor’s philosophical belief that the relevant factor or factors will be rewarded, and willingness to tolerated periods of meaningful (hopefully short-lived) underperformance resulting from that factor in order to achieve an expected long-term premium. Implementation may often involve use of specific non-benchmark indices (i.e. tilts may generally be determined by an index provider, not the asset manager that provides the structure, although this depends on the complexity of the strategy being offered).

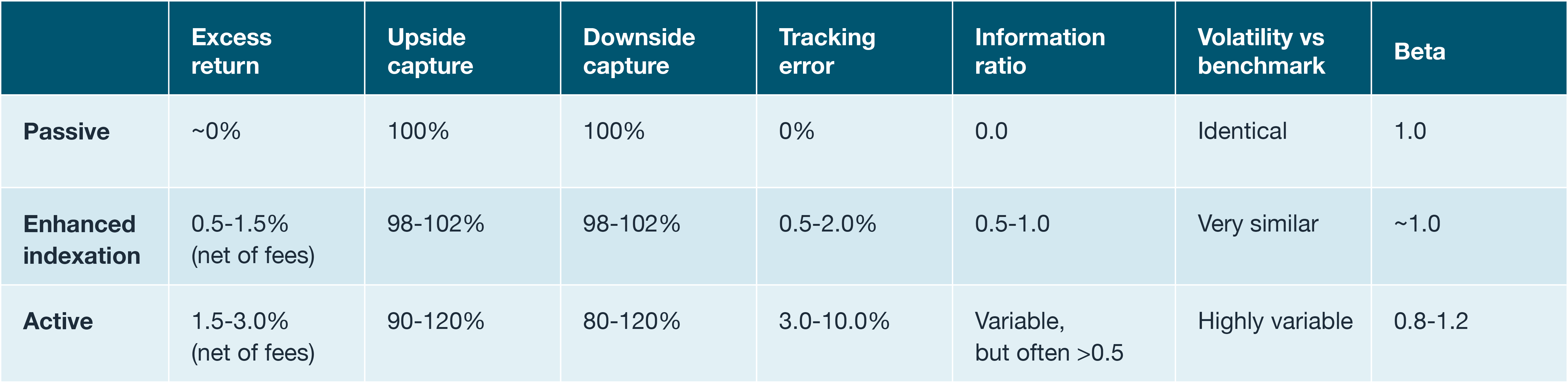

Investment intentions: what do different equity investment approaches seek to deliver?

*Based on asset managers’ communicated expectations during bfinance asset manager research. Figures are illustrative only and indicate stated expectations for a full market cycle. These figures do not reflect actual historical performance.

2: Three main types of Enhanced Indexation

Enhanced index strategies aim to deliver consistent outperformance by tilting the composition of an index towards stocks exhibiting desirable performance traits. This approach relies on systematic scoring methods to rank stocks, guiding moderate active weights while minimising overall deviations from the index in areas such as sector, size, or country. Quantitative techniques like optimisation are central to maintaining benchmark alignment, enabling these strategies to balance incremental return potential with controlled active risk.

One can identify three main methods of stock scoring, which in turn give rise to three broad strategy families within the Enhanced Indexation space:

- Traditional factor-based approaches build their stock selection process around a blend of established fundamental factors – typically value, momentum, quality, size, and low volatility, often referred to as the ‘big five’. Each factor brings a unique performance driver, and each manager interprets these factors differently by selecting specific sub-factors to define their strategy. Value, for example, is not a uniform concept: one manager may measure it through P/E ratios, while another may focus more on P/B or cash flow-based metrics (in practice we see various combinations being used). The asset manager will seek to balance exposures to each factor in order to reduce the volatility of active returns versus the benchmark.

- Alternative factor-based strategies may still draw on the ‘big five’ factors but heavily incorporate non-traditional data sources like sentiment analysis, macroeconomic indicators and trade flow data. Insights are often driven by artificial intelligence and natural language processing (NLP), using unstructured data from sources like social media, financial news, and earnings call transcripts to capture shifts in investor sentiment and market trends that traditional factors might overlook.

- Analyst-guided strategies form a smaller but distinct segment of the Enhanced Indexation landscape. These strategies integrate qualitative insights from fundamental research analysts, focusing on stock-specific attributes such as management quality or competitive positioning. By blending bottom-up analysis with systematic implementation, these ‘active-lite’ approaches seek to deliver benchmark-aligned returns while capturing unique company-level insights.

While we present these as distinct categories, traditional and alternative approaches are not mutually exclusive; many managers blend both approaches and the distinction between strategies lies in the relative emphasis on the different approaches. For instance, a traditional factor-based strategy might allocate 80-90% to fundamental factors, with the remaining 10-20% based on alternative sources to supplement or complement their fundamental insights. Conversely, an alternative-focused strategy would lean heavily on alternative data while maintaining a smaller, ‘stabilising base’ in traditional factors. Looking ahead, with the rapid growth in AI and machine learning, we could reasonably expect that alternative insights will become increasingly prominent over time.

3: Performance and risk characteristics of Enhanced Indexation strategies

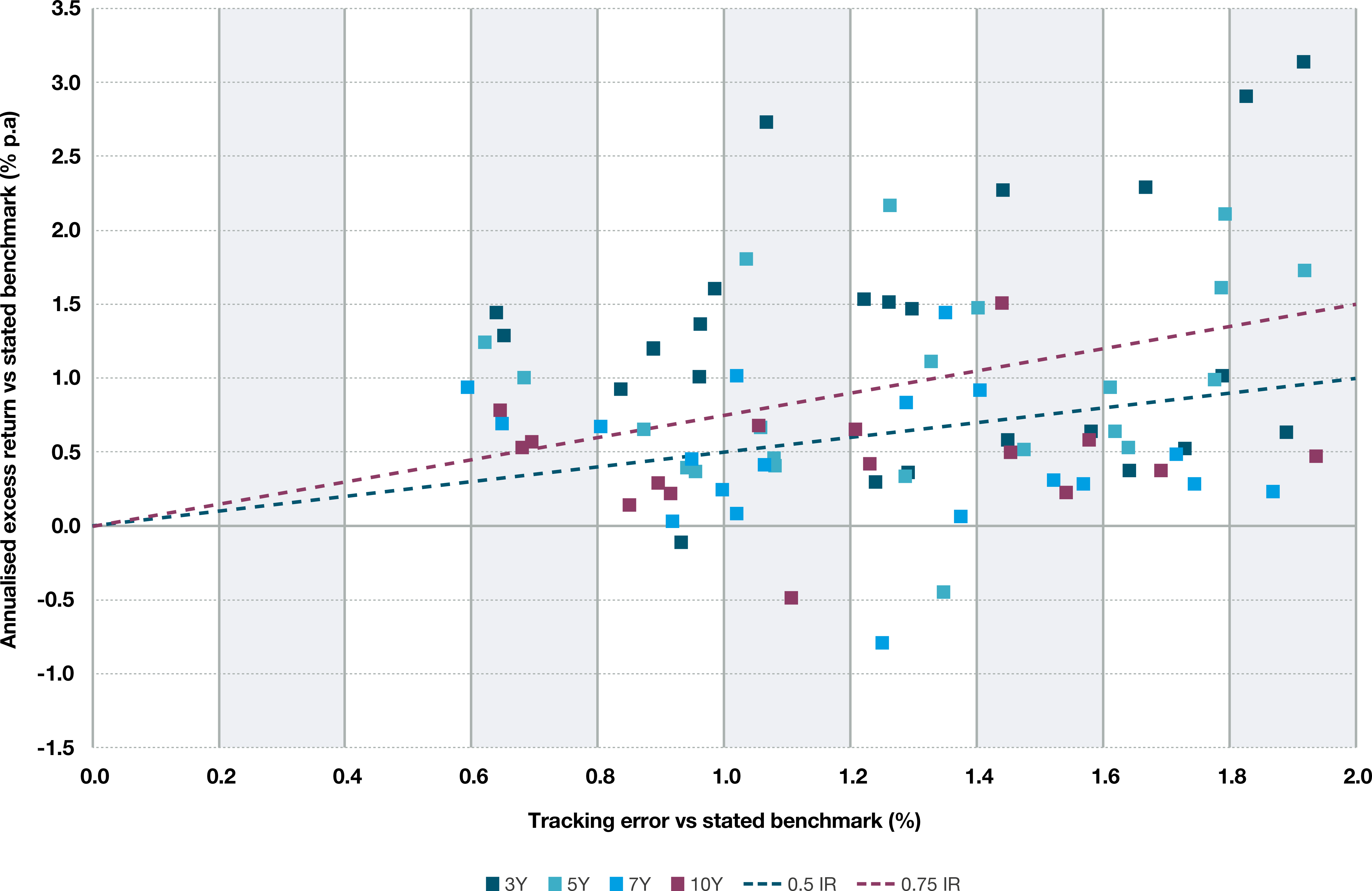

The objectives of enhanced indexation strategies are often expressed in terms of excess return and tracking error, or through an Information Ratio (IR) to indicate the expected level of ‘efficiency’. The chart below shows the relationship between tracking error and excess return for a bfinance-constructed peer group of global enhanced index strategies, differentiated by time horizons (3, 5, 7, and 10 years).

Excess return vs tracking error – Global enhanced equity, trailing periods to Sep-24, net of representative management fees

Source: bfinance, eVestment. Data over 3, 5, 7 and 10-year periods to 30 September 2024. Returns net of representative 20bps management fee. Results are not indicative of future performance.

The chart indicates that the vast majority of enhanced index strategies have achieved their objective, clustering in the 0.5-1.5% excess return range, with tracking error of 1-2%. The blue and burgundy dotted lines represent Information Ratios of 0.5 and 0.75, providing a benchmark for the efficiency of risk-adjusted returns: most data points lie above the 0.5 IR line, and many above the 0.75 IR line, highlighting a strong ratio of excess return per unit of active risk.

While Enhanced Indexation strategies are designed for consistent outperformance, certain market environments can present challenges. One such example was 2020, where the onset of the pandemic led to unprecedented patterns in stock performance and temporarily disrupted almost all traditional factor relationships. However, in the ensuing ‘Magnificent 7’ era, where a narrow group of large cap tech stocks has driven market performance, enhanced index strategies were favourably placed: they benefited from their tendency to hold near-index weights and took on meaningful exposure to the growth leaders while maintaining diversified factor tilts.

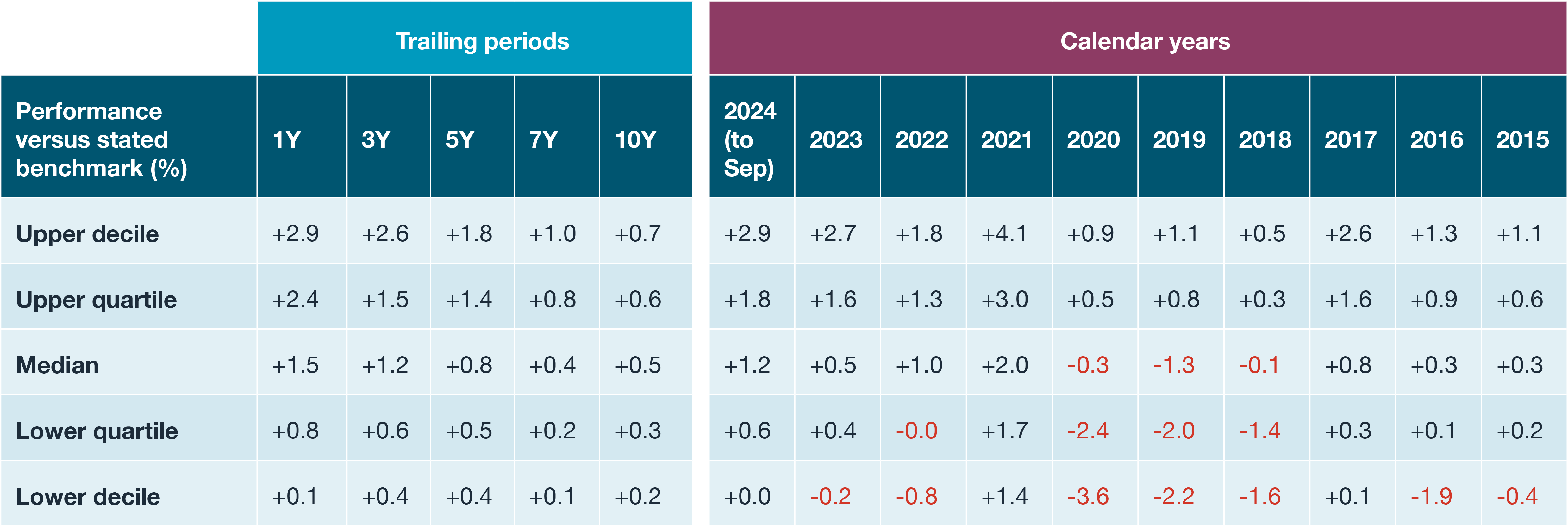

Excess returns – Global enhanced equity, trailing (to Sep-24) and calendar year periods, net of representative management fees

Source: bfinance, eVestment. Trailing periods to 30 September 2024. Returns net of representative 20bps management fee. Results are not indicative of future performance.

4: Implementation approaches for Enhanced Indexation

To function effectively, Enhanced Index strategies (particularly those that are founded on established factors) typically require both ‘market breadth’ and liquidity. As such, they are generally used for relatively large investable universes; global strategies are by far the most common. We also find a good variety of regional strategies (particularly EM, Europe and Asia Pacific) and single-country strategies (US and China). Focusing specifically on global equities, where much of our recent search activity in this space has taken place, we count more than 25 asset management firms with relevant live strategies.

Customisation is extremely common: we have observed managers being very willing to adjust ‘house’ approaches to meet the specific objectives of an investor, such as ESG exclusions, Net Zero alignment, reduced carbon intensity, Shariah-compliance and more.

Typically, the investment manager will base the strategy on a mainstream market index, rather than using alternative indices (the latter would commonly be employed in a Smart Beta strategy). Depending on mandate sizes and levels of customisation, we observe typical management fees in the 10-30 basis points range.

Conclusion

With its narrower and more benchmark-like range of outcomes, Enhanced Indexation is a potentially valuable tool in investors’ toolkits. It may constitute an appropriate alternative to pure passive management, or a cost-effective alternative to active management (particularly where core styles are being favoured). Its strong scope for customisation – both at the outset and over time as conditions evolve—provide a notable additional attraction.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)