IN THIS PAPER

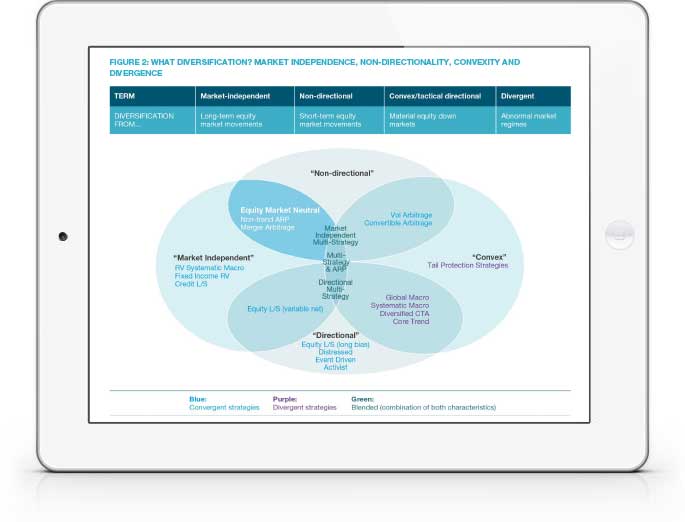

Introducing EMN. Equity Market Neutral (EMN), valued at around US$50 billion, is a niche and distinct fragment of the broader Equity Long/Short family, currently estimated to be worth US$1.1 trillion. This pure alpha-oriented ‘non-directional’ and ‘market-independent’ strategy offers diversification from equity movements, without providing convexity.

Do current conditions favour EMN? Theoretically, volatility is favourable for EMN strategies since it drives increased dispersion in the performance of stocks and sectors. However, significant levels of volatility can prove problematic because a sudden spike—as may be experienced during a market downturn—can impede EMN performance.

Manager selection considerations. More than 260 asset managers offer EMN strategies, but there is considerable variation between managers: the difference between the lower quartile and upper quartile over the past three years is almost 6%, so investors must assess managers carefully.

WHY DOWNLOAD?

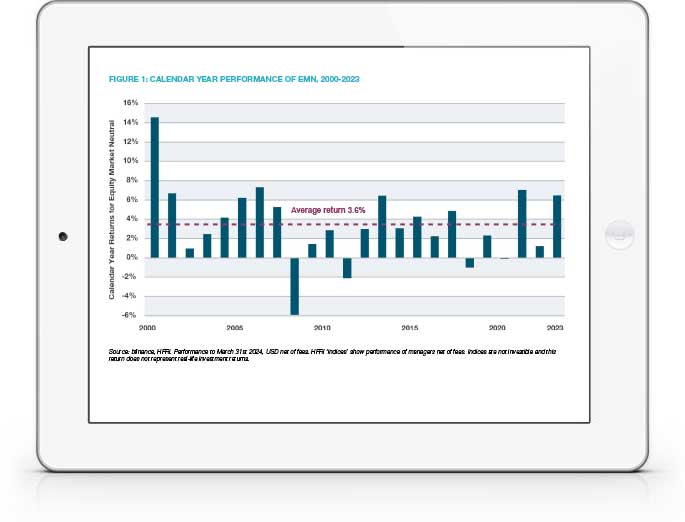

EMN managers are enjoying a revival in the new macroeconomic environment. Indeed, during the first year that the Federal Funds rate neared or exceeded 5% (April 2023-March 2024), EMN strategies delivered average returns above 10% net of fees.

In the ten years to 2020, EMN strategies fell out of favour. Annualised returns during that period averaged a lacklustre 2.3% per annum as a prolonged period of historically low interest rates, weak inflation, and low volatility dampened performance. Today, however, EMN may benefit from the higher-rate environment, escalating geopolitical tensions and rich equity markets.

In this brief introductory report, we take a closer look at EMN strategies. We hope that it supports investors in gaining a stronger understanding of this niche but exciting sector and its significance in today’s climate.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)