IN THIS PAPER

Global sukuk, a beacon of hope for fixed income investors

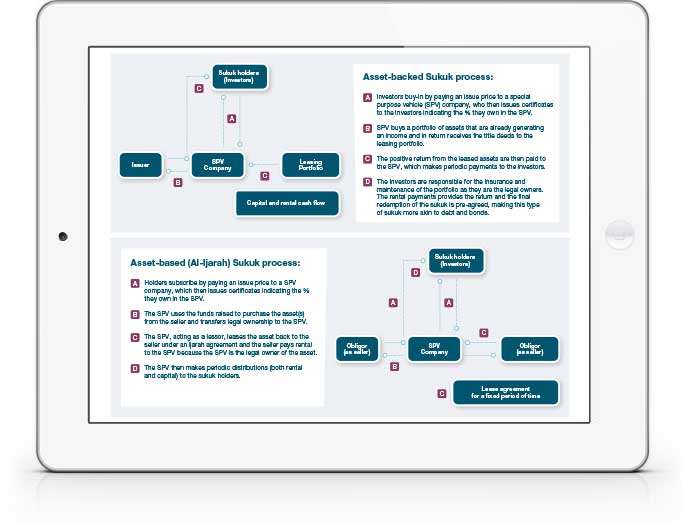

Understanding the asset class and its process of creation: Sukuk and traditional bonds are similar in many ways and often serve the same purpose when included in one’s portfolio. However, the methods in which they are established and the drivers that determine their returns are vastly different, not to mention that one is compatible with Shariah law while the other is strictly forbidden.

Investment use cases and performance: The Global Sukuk market has demonstrated its resilience during a time of uncertainty for fixed income markets, offering investors pockets of positive returns in an otherwise challenging universe. Sukuk bonds often do not carry a strong link to inflation or interest rates, therefore making them a viable option during periods of high inflation and when recessionary fears loom.

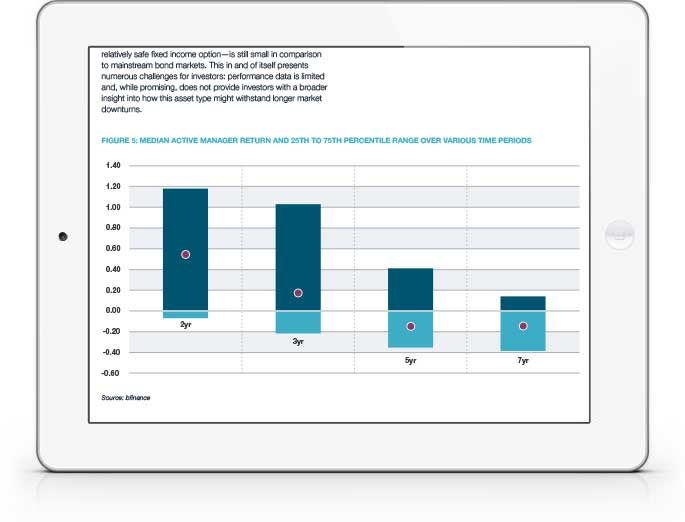

Implementation and asset manager selection: The universe of active managers in the Global Sukuk space is small but growing, with over 25 managers now offering mandates, and there are a number of ways in which investors can gain exposure to this niche asset class. Despite its size, Global Sukuk has been a rather bountiful area for active management in recent years, consistently outperforming the benchmark, net of fees, over various periods.

WHY DOWNLOAD?

This small but growing market has much to offer

The Global Sukuk market has evolved significantly, evidenced by the sharp increase in sukuk issuance, with overall issuance almost tripling from US$60 billion in 2015 to more than US$160 billion in 2023. The overall amount of sukuk outstanding last year was US$870 billion, reflecting a significant increase from the US$490 billion reported in 2019.

This increased demand is reflected in the performance of the global sukuk market. Currently, sukuk demand is exceeding supply, making this investment vehicle highly resilient during market downturns because investors are opting to sell alternative assets while holding their sukuk exposures, and this strategy appears to be paying off.

While perhaps not the most lucrative asset class, Global Sukuk continues to attract investors thanks to its shorter duration, higher quality and returns in-line with what investors would expect from traditional bonds—which have struggled to offer investors attractive returns recently, due to the current inflationary environment, coupled with high interest rates—but with lower volatility risk.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Français (France)

Français (France)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)