bfinance insight from:

Mathias Neidert

Managing Director, Fixed Income

Kathryn Saklatvala

Senior Director, Head of Investment Content

The 2022-2024 period has provided new tests for investors’ fixed income and alternative credit portfolios, thanks to the repercussions of heightened interest rates and ever-extending expectations surrounding the pace of prospective cuts. We sat down with Mathias Neidert to ask: where should investors be focusing attention now? With high yield bond spreads nearing historic lows, he highlights the relative appeal of leveraged loans as well as a potential “once-in-a-lifetime arbitrage opportunity” in CLO equity.

Q: How attractive are higher-yielding credit sectors in the current environment?

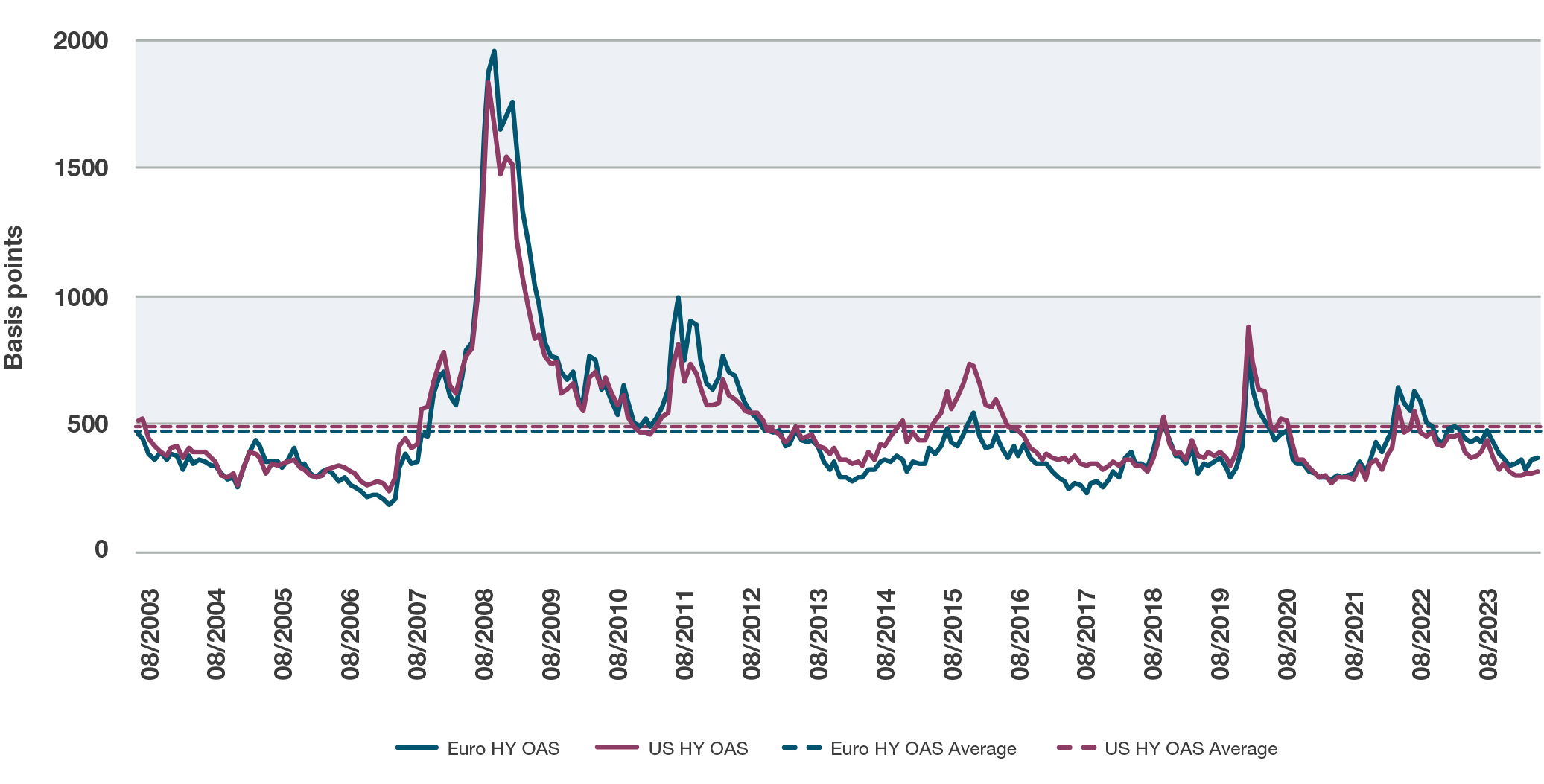

This is a challenging and interesting subject right now. After approximately two years of elevated interest rates, high yield bond spreads have fallen far below historical averages, as shown in Figure 1. This is leading investors to focus on other (liquid and illiquid) sub-investment grade credit assets.

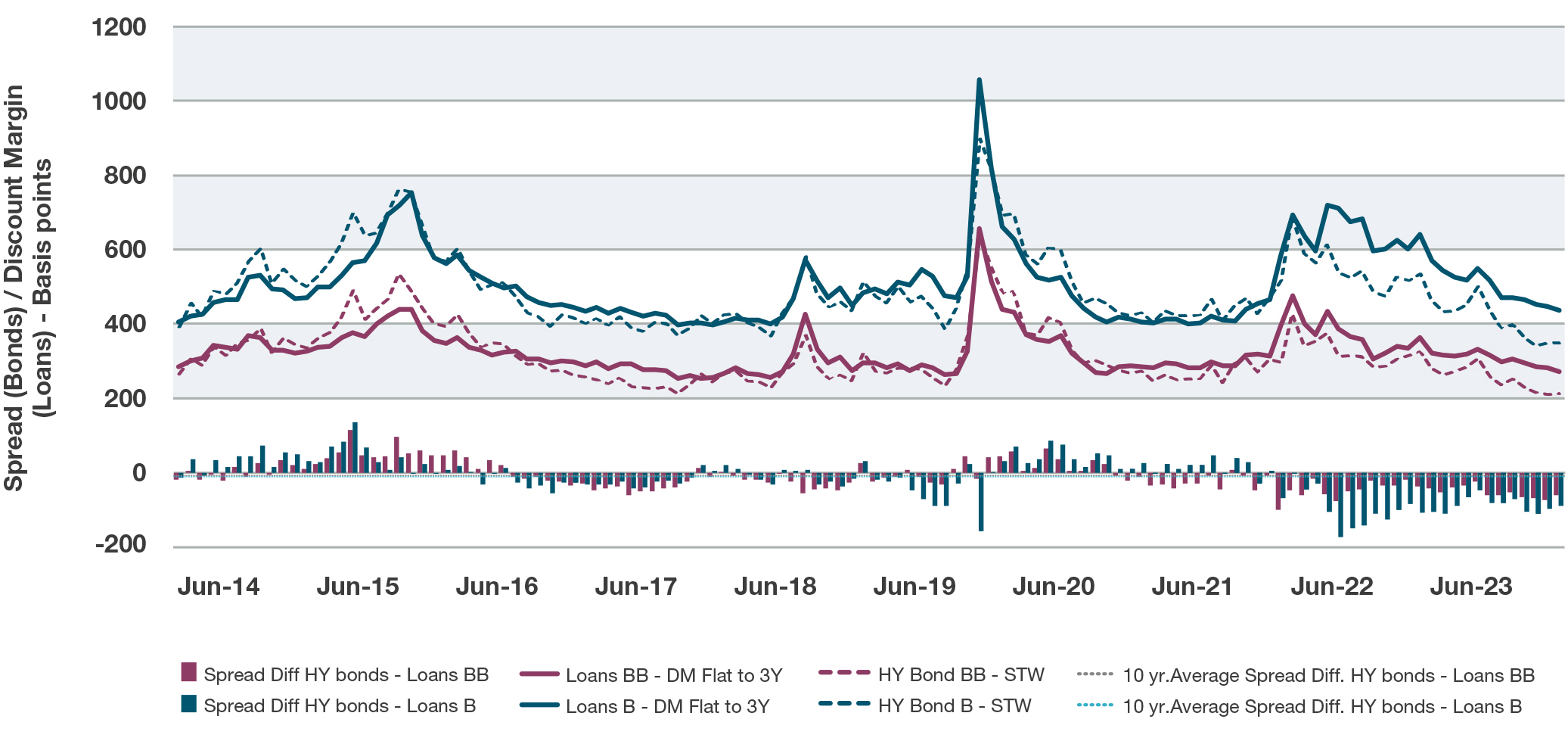

For example, as illustrated in Figure 2, the spread differential between leveraged loans and high yield bonds is currently very wide by historical standards: spreads have tightened in leveraged loans, but at a slower pace than we’ve seen in the high yield bond market. CLOs are also looking comparatively attractive, with what appears to be a particularly interesting opportunity in CLO equity. Meanwhile, spreads in private credit have remained relatively robust, though this is partly due to complex structures that allow—for example—payment-in-kind on loans. The lines between liquid and illiquid credit exposures have, indeed, become increasingly blurred with the evolution of semi-liquid private credit vehicles.

Figure 1: High yield bond credit spreads (OAS)

Source: Bloomberg

Figure 2: Spread differentials - HY Bond vs Loans in the US

Source: bfinance, J.P.Morgan

For investors, this is a great time to reconsider exposures to sub-investment grade credit sectors and the strategic approaches being used. For example, allocators can think about whether to add new dedicated allocations to niche asset classes within (liquid or illiquid) credit, or indeed introduce multi-asset credit (MAC) strategies that can invest in a range of sub-investment grade sectors without the need for a specific allocation.

When considering this subject, it is always important to remember that relative value between the various credit sectors can change rapidly as a result of shifts in economic fundamentals or market technicals.

Q: You mentioned that CLO equity is particularly attractive now. Why is this the case?

CLO equity is essentially an arbitrage strategy that captures the differential between what a CLO earns (interest received on leveraged loans in the CLO’s book ) and what it owes to its own debt holders.

As such, it performs best when there’s a significant gap between the price of CLO debt and the yields delivered by leveraged loans. This is strongly in evidence now. Leveraged loans (which generally have a floating rate profile) have continued to provide strong yields, spread compression notwithstanding. Meanwhile, the cost of CLO debt has tightened significantly over the past 12 months, thanks to heavy volumes of new issuance (propelled by a huge tightening in CLO liability spreads, which lowered the weighted average cost of capital for new CLOs from 299bps in Q4 2022 to 213bps in Q1 2024 – the largest tightening of liability spreads seen in many years). This combination has created what may indeed be a once-in-a-lifetime arbitrage opportunity for investors.

Investors considering CLO exposure should eye the leveraged loan market with care, however. Merger and acquisition activity—the lifeblood of new leveraged loan issuance—has been subdued. If CLO managers cannot find sufficient appropriate deal volume for reinvesting assets into new leveraged loans, they may increasingly look to the leveraged loan secondaries market . The theme was debated in a recent widely-shared Bloomberg article (CLOs Have Too Much Money and Are Running Out of Things to Buy, June 29th 2024).

Q: For investors thinking about CLO equity: should this sector be part of a fixed income allocation or should it sit elsewhere in the portfolio?

This is an interesting subject and investors categorise the asset class differently. It could be included within a portfolio of fixed income, sit alongside alternative investments (such as private equity) or be part of a dedicated opportunistic credit allocation. Like other non-traditional credit betas, CLO equity combines some credit characteristics with other idiosyncratic factors not typically found in “mainstream” asset classes.

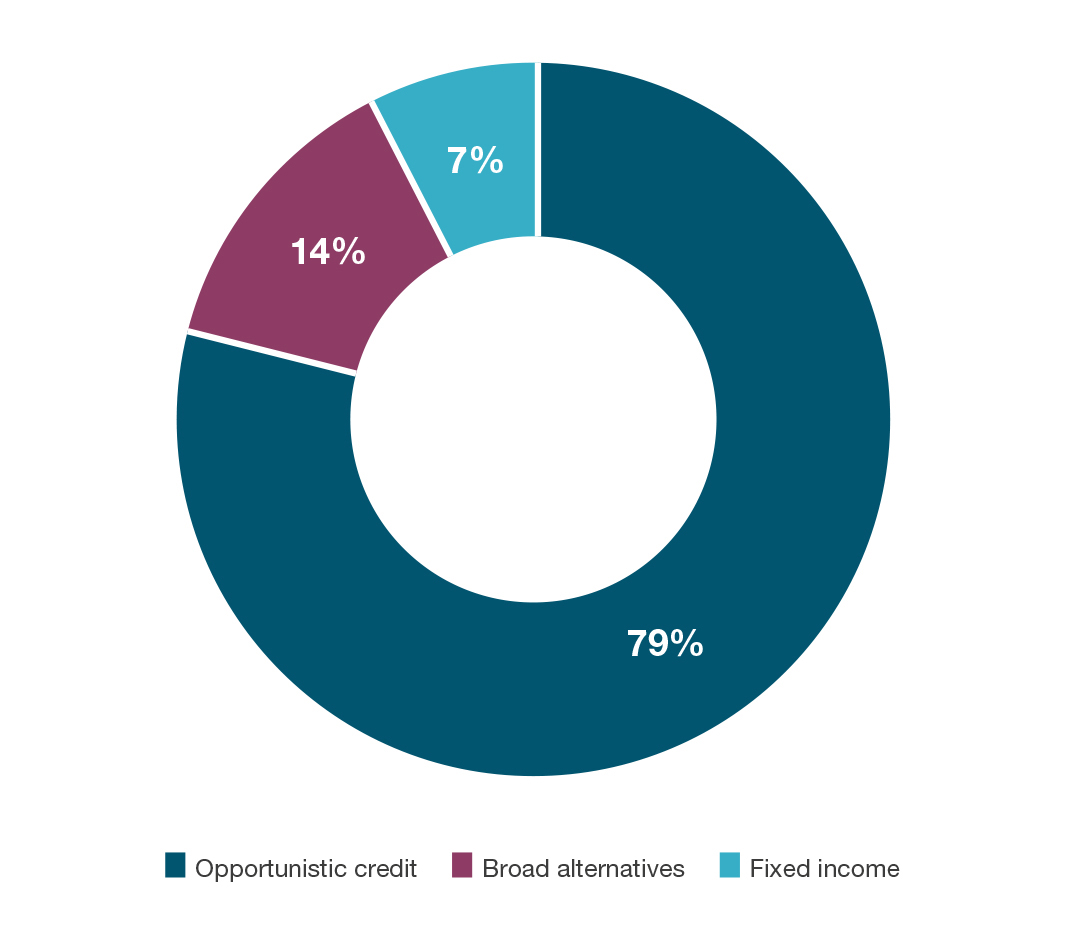

According to data from Nuveen below, the most popular approach is to include CLO equity within an opportunistic credit allocation where it can sit alongside strategies such as specialty finance, distressed credit and more. Practices vary by investor type: an insurer, according to Nuveen, is more likely to classify CLO equity within the fixed income allocation than a pension fund, who may prefer to include the strategy in an alternative investment allocation.

Figure 3: Where does CLO equity fit in a portfolio?

Source: Nuveen. Based on an anonymised survey conducted on 29th June 2021. No representation is made as to the applicability of these results.

The decision will also be affected by the way in which exposures are being implemented. For example, if an investor is gaining CLO exposure through a Multi Asset Credit strategy rather than a dedicated CLO strategy, this will tend to sit in the fixed income allocation. MAC funds invest in various sectors (loans, HY bonds, CLOs) and may exploit shifts in relative value through tactical allocation as well as seeking to add value on a fundamental bottom-up basis.

Q: What are the implementation options for CLO equity investing?

If we look beyond the aforementioned MAC strategies that provide CLO exposure, there are over 80 dedicated funds investing in various segments of the CLO capital structure with varying risk, return and liquidity profiles.

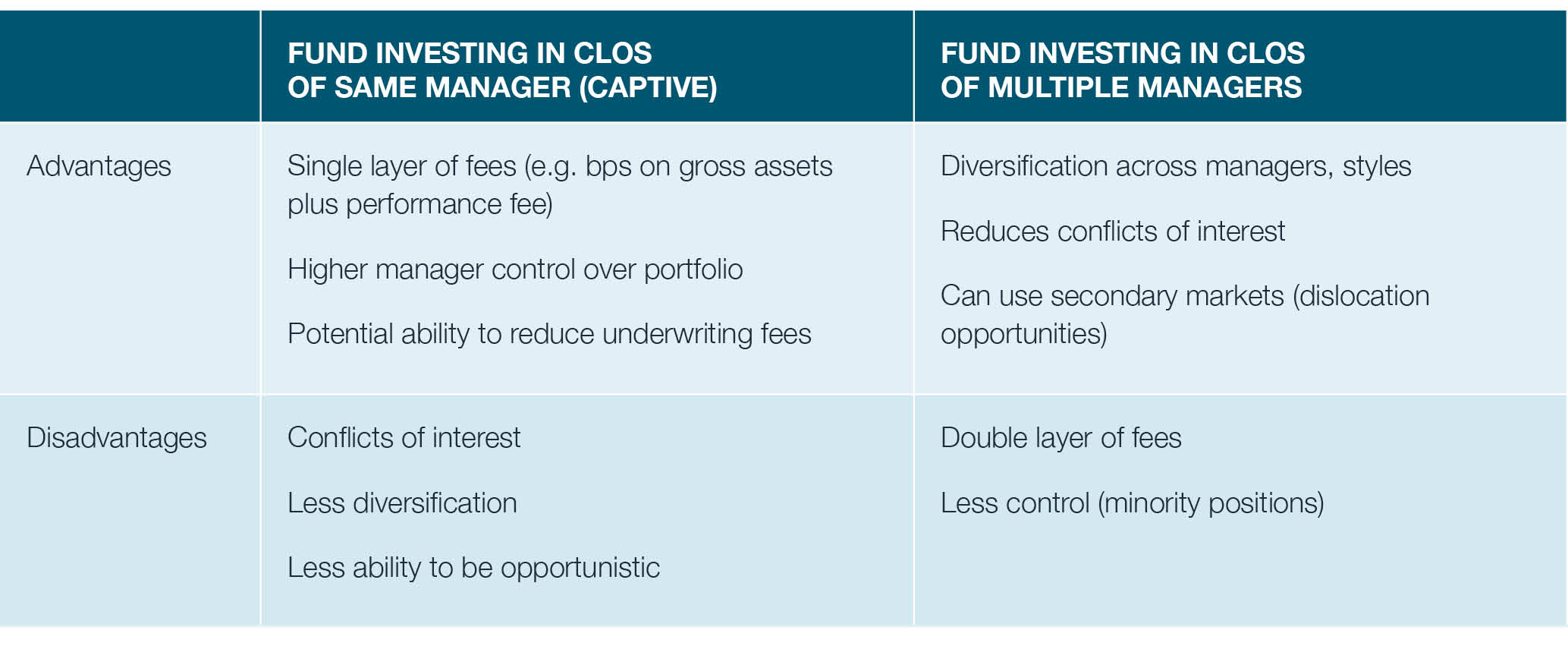

Notably, these include some captive CLO equity funds set up by CLO managers to fund the equity tranche of their own CLOs (using others’ money rather than their own, in essence!). Carlyle’s first captive equity fund, for example, raised US$600 million earlier this year. While captive CLO strategies may sound potentially problematic (or at least conflicted), they do have some interesting advantages.

Figure 4: Captive CLO equity strategy pros and cons

Conclusion

As investors navigate through a higher-for-longer climate, the fall in high yield bond spreads is provoking investors to re-examine their approach to sub-investment grade credit – with leveraged loans, CLOs, private debt and other asset class in mind. The current opportunity in CLO equity may merit particular attention and, for investors that do not currently have a natural home within the portfolio for this asset class, the constraints that prevent exposure should be considered with care.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

English (Global)

English (Global)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)