bfinance insight from:

Toby Goodworth

Managing Director, Liquid Markets

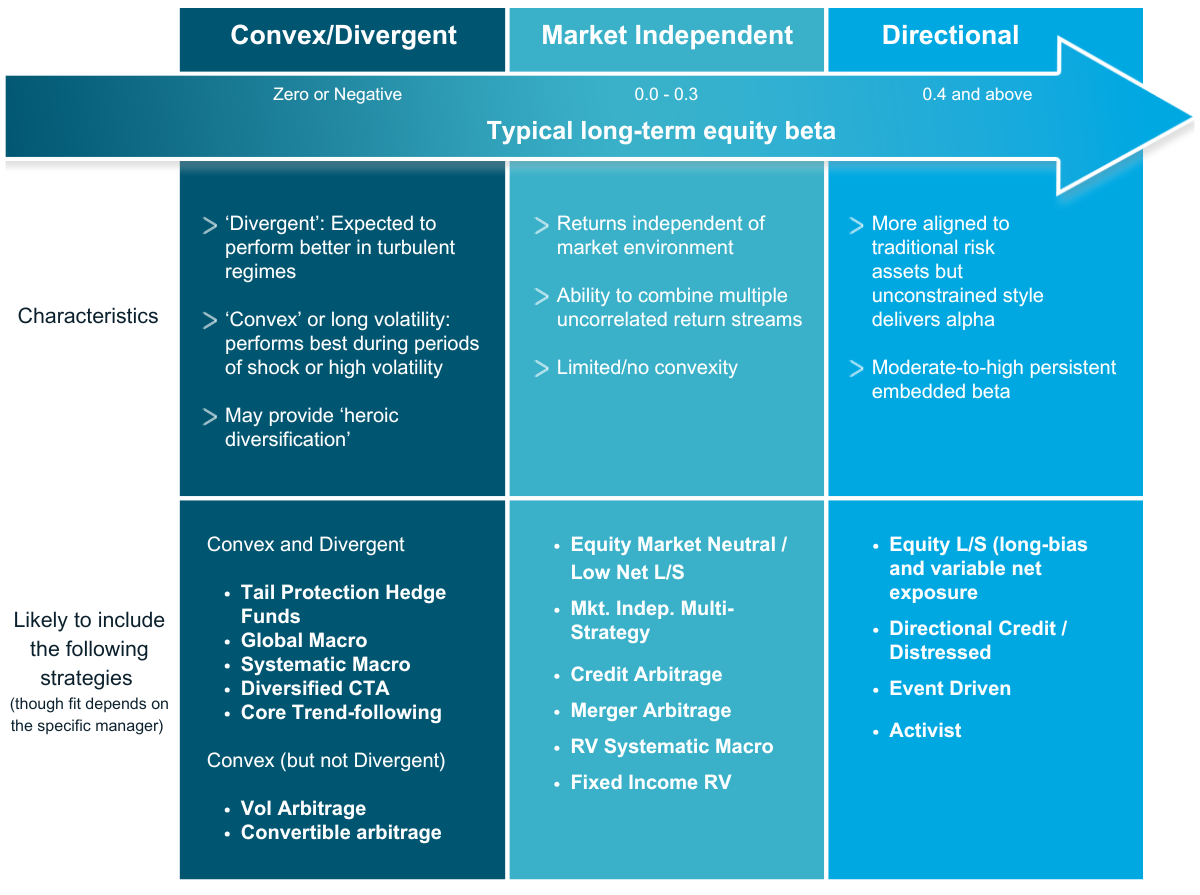

Conventional hedge fund classifications, as taught by bodies such as the CFA Institute and CAIA, are based on asset managers’ investment techniques, processes and instruments: equity hedge, event-driven, relative value, global macro, managed futures. For an investor seeking to build an effective portfolio, however, these labels are not particularly helpful.

For portfolio design, especially from the perspective of an institutional investor, such as a pension fund or endowment, only one thing matters: the profile of returns in relation to the mainstream markets, especially equity markets, that form the core of their existing risk allocations. All hedge funds can be classified into one of three return style groups: market-independent, convex/divergent or directional. These three descriptors help us to structure portfolios around the core question: what do these exposures actually offer within a total portfolio context, as opposed to within a hedge fund or strategy-specific silo?

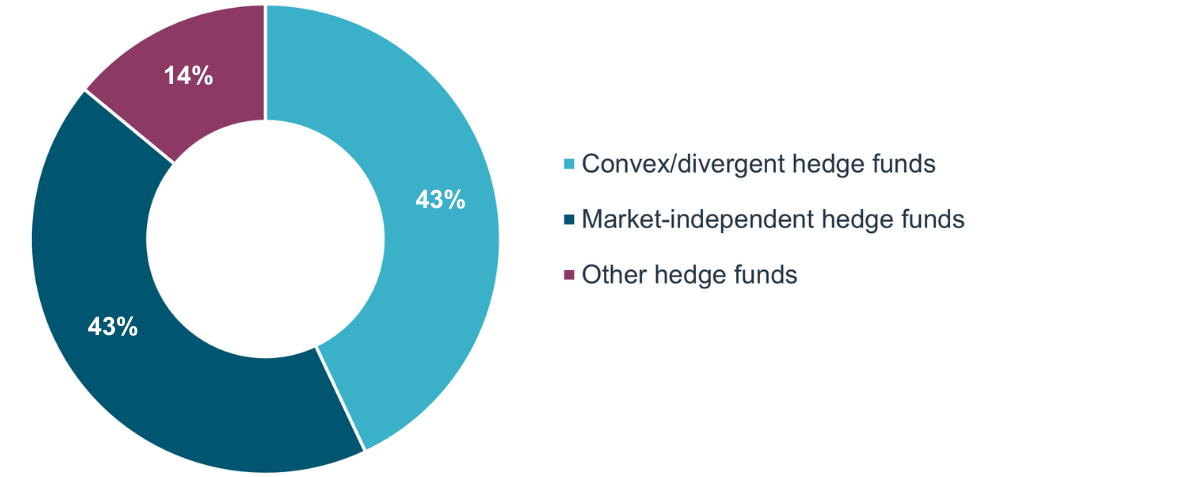

Figure 1: Classifying Convex/Divergent, Market Independent and Directional hedge funds

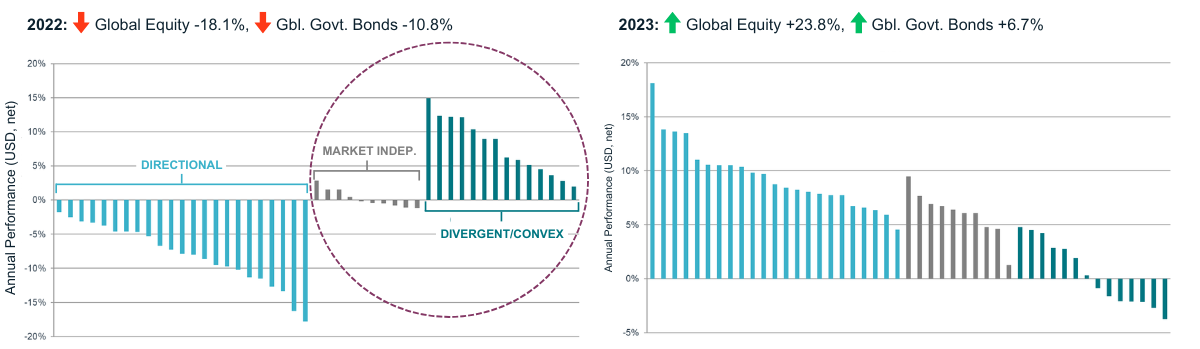

In difficult years, when equity markets are broadly in retreat, we find very clear differences in returns between these three groups. As shown in Figure 2 below, 2022 provided an excellent example of this effect. Strategies in the convex/divergent bracket, such as Tail Protection Hedge Funds and Global Macro, offered meaningful ‘heroic diversification,’ as did many equity risk overlays (indeed, this portfolio risk management strategy can usefully be considered alongside convex/divergent strategy exposure). Meanwhile, 2023 provided a good year for risk asset performance, which of course led to high returns for directional strategies, but also featured strong positive performance for market-independent strategies—such as Equity Market Neutral—that had largely resisted losses in 2022.

Figure 2: Performance of three hedge fund strategy families in 2022 (left) and 2023 (right)

Source: bfinance. Each column indicates performance of a group of hedge fund strategies under a particular label, assigned into Directional, Market Independent and Divergent/Convex groupings (as indicated in Figure 1).

Overall, the 2020-2024 period has emphasised the benefits of exposure to both market-independent and convex/divergent strategies. Used together, these two different forms of defensive diversification can provide a more robust overall profile. As well as improving long-term risk-adjusted returns, defensive diversification can have other key benefits, such as providing valuable dry powder for investors in periods when liquidity may be constrained and investment opportunities can become more attractive. This dual-diversifying approach to portfolio construction was explored in a 2021 white paper: How to Build a Hedge Fund Allocation.

Why focus on defensive diversification now?

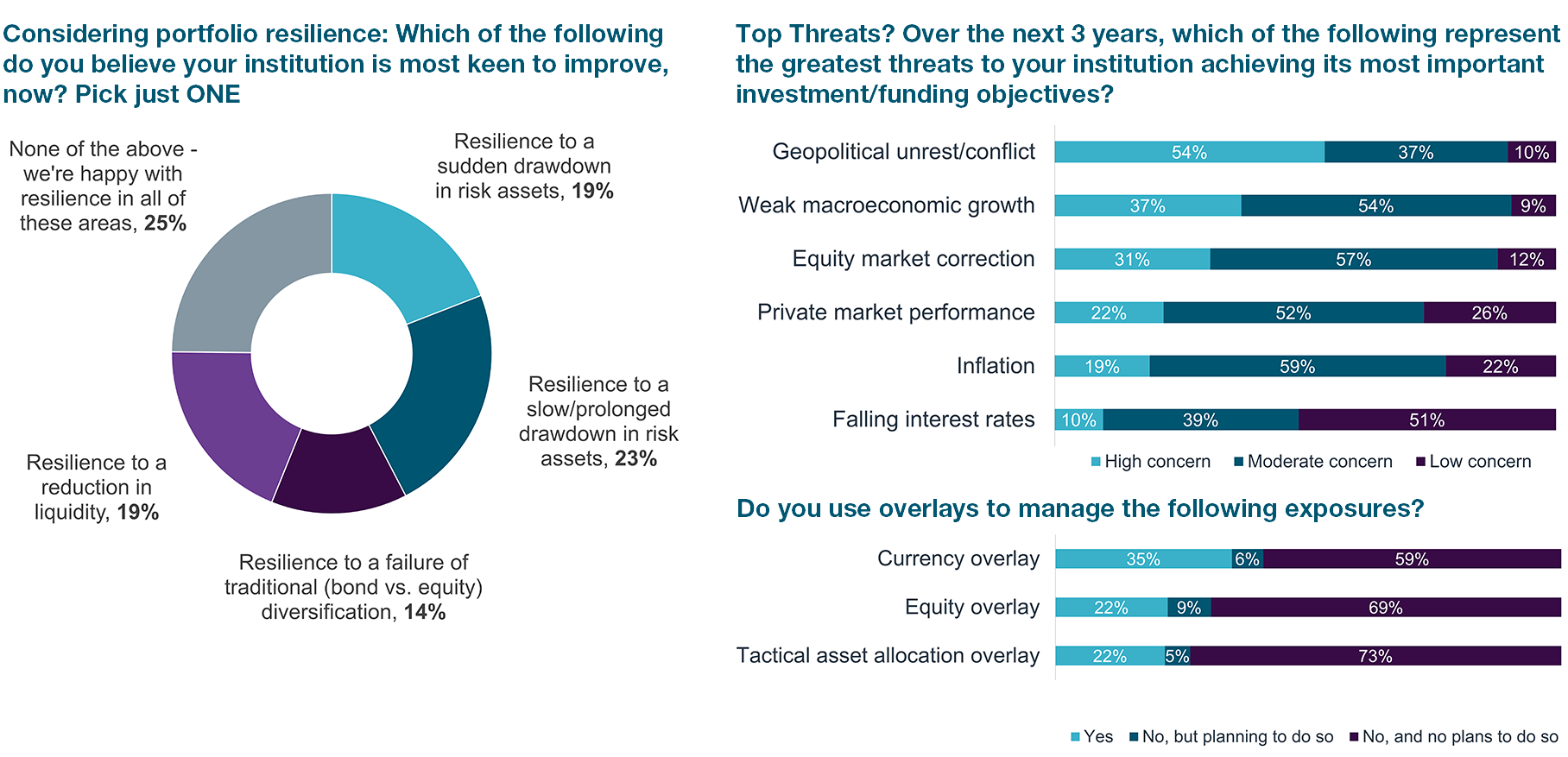

Defensive diversification—the inclusion of usefully different return streams in portfolios—is front of mind in 2024. According to the latest bfinance Asset Owner Survey, conducted in October, 75% of investors are seeking to improve portfolio resilience, although their specific priorities vary considerably (protection against sudden drawdowns in risk assets, resilience to slow-prolonged drawdowns, liquidity concerns, et cetera). Equity markets are at high levels, notwithstanding global growth concerns and heightened geopolitical risks. Bonds are not a guaranteed diversifier, as was starkly illustrated in 2022. Private market distributions have softened amid a weak climate for exits and investors are questioning the persistence of illiquidity premia: 47% of investors in that survey believe that the illiquidity premium has shrunk versus the 2000-2020 period, or even inverted.

Figure 3: Asset owner views on portfolio resilience, top threats and overlays

Source: bfinance Asset Owner Survey, 2024

Meaningful obstacles can still prevent or dissuade many investors from building up exposure to defensive diversifiers in general, and hedge funds in particular. These include still-high fees, complexity and return disappointment (including a protracted period of underperformance alongside the historic equity bull market that followed the 2008 financial crisis). The apparent positive trajectory in equity overlay activity illustrated in Figure 3, which shows 9% of Asset Owners planning to introduce equity risk overlays to portfolios, is not mirrored by an expected increase in hedge fund usage. Specifically, 37% of Asset Owners in that study invest in hedge funds and the proportion planning to increase exposure over the next 12 months (8%) is counterbalanced by a similar percentage of investors intending to decrease exposure (7%).

That being said, the year has brought some high-profile examples of influential institutional investors seeking to ramp up commitments to hedge funds. For example, Australia’s Future Fund released a position paper in June indicating that they would look towards Equity Market Neutral and Systematic Macro strategies, declaring “the era of using government bonds to diversify equity-related risk is over.” Looking across bfinance’s client base, we have seen a notable increase in hedge fund manager search activity from mid-2023 onwards. Notably, more than 80% of hedge fund searches in this recent period have focused on defensive diversification (market independent or convex/divergent).

Figure 4: Hedge fund searches, 12 months to June 30 2024, by category

Source: Manager Intelligence and Market Trends, bfinance, August 2024

Managing diversification expectations

It remains to be seen whether the turbulent twenties will bring a broader positive trend in favour of hedge fund exposure among asset allocators. One thing is clear: the importance of defining the purposes of ‘diversifying’ exposures and, in doing so, clarifying different forms of diversification.

As well as improving long-term risk-adjusted returns, a well-defined approach is crucial when communicating to stakeholders and managing their expectations. Everyone involved should understand which types of diversification are being obtained, what they should be expected to deliver and in which conditions. An approach to hedge fund classification that is based on return style rather than investment process can help to provide that clarity, supporting effective communication and governance.

Important Notices

This commentary is for institutional investors classified as Professional Clients as per FCA handbook rules COBS 3.5R. It does not constitute investment research, a financial promotion or a recommendation of any instrument, strategy or provider. The accuracy of information obtained from third parties has not been independently verified. Opinions not guarantees: the findings and opinions expressed herein are the intellectual property of bfinance and are subject to change; they are not intended to convey any guarantees as to the future performance of the investment products, asset classes, or capital markets discussed. The value of investments can go down as well as up.

Français (France)

Français (France)  Deutsch (DACH)

Deutsch (DACH)  Italiano (Italia)

Italiano (Italia)  Dutch (Nederlands)

Dutch (Nederlands)  English (United States)

English (United States)  English (Canada)

English (Canada)  French (Canada)

French (Canada)